Small Business News

Kabbage from American Express Introduces Kabbage Funding

When it comes to small business success, one of the most important factors is cash flow. Given this reality, American Express has announced the launch of Kabbage Funding, giving business owners another option for obtaining working capital.

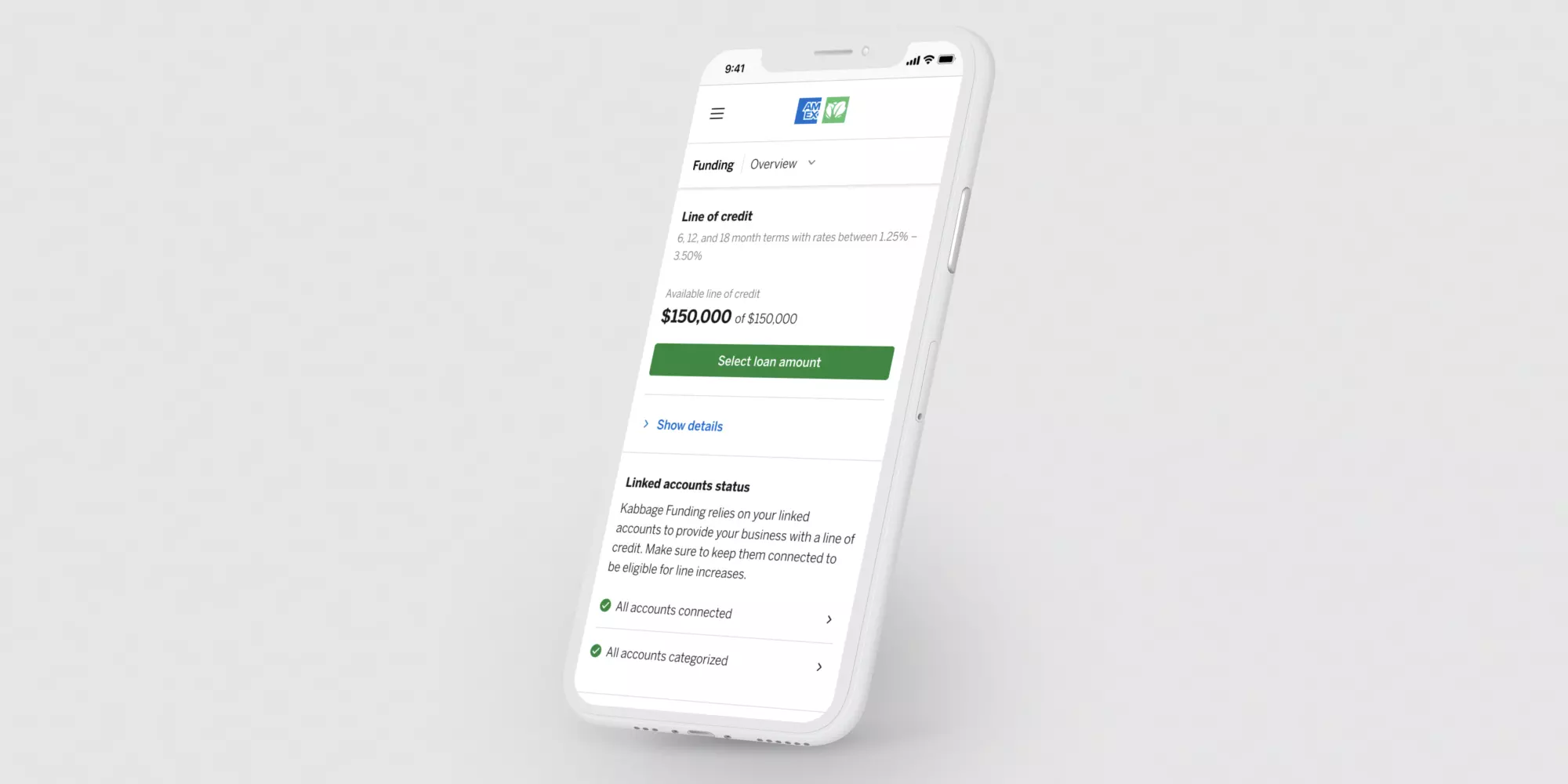

Eligible small businesses can now open flexible lines of credit, ranging from $1,000 to $150,000. According to the company, the application process can be completed in minutes, giving business owners quick access to capital. This option comes with no application fees, origination fees, annual fees, or monthly maintenance fees. Once approved, businesses will not need to reapply in order to access their line of credit and draw funds.

The launch of Kabbage Funding follows American Express’s acquisition of the FinTech Kabbage last year. Since then, the company has introduced Kabbage Checking as well. Incidentally, that launch was later followed by Amex also debuting a different business checking account. Although the two account options do bear some similarities, Kabbage Checking accounts are provided by Green Dot Bank while the more recent American Express Business Checking comes from American Express National Bank.

Elsewhere, this new line of credit option also continues American Express’s long-standing commitment to small businesses. The most high-profile example of this focus is Small Business Saturday, which yielded a reported $23.3 billion in sales last month — a record figure for the retail holiday’s 12-year run so far. Meanwhile, since the pandemic, Amex has also rolled out several grant programs and made other efforts to assist entrepreneurs during what’s been a turbulent time.

Commenting on the launch of Kabbage Funding and the need for it, the company’s co-founder and Amex SVP Rob Frohwein stated, “Most small business owners start a company to pursue a passion, not to spend time managing their cash flow and balancing their books. Our suite of digital cash flow solutions is designed to give small business owners back time in their day, and Kabbage Funding offers convenient funding whenever they need it.” In their press release, Amex also noted that the new offering “builds on American Express’s momentum to go beyond the Card and become an essential partner to small businesses through a broad range of cash flow management tools.”

With American Express’s purchase of Kabbage still fairly fresh, it’s clear that the company is now ready to start putting the brand’s technology to work. Beyond Kabbage Funding and Kabbage Checking, Amex also plans to further expand its Kabbage Payments feature — which offers invoicing and card payment acceptance solutions — in 2022. Going forward, it will be interesting to see what other products and offerings come out of the new Kabbage and how they might benefit small businesses across the country.