Economic News

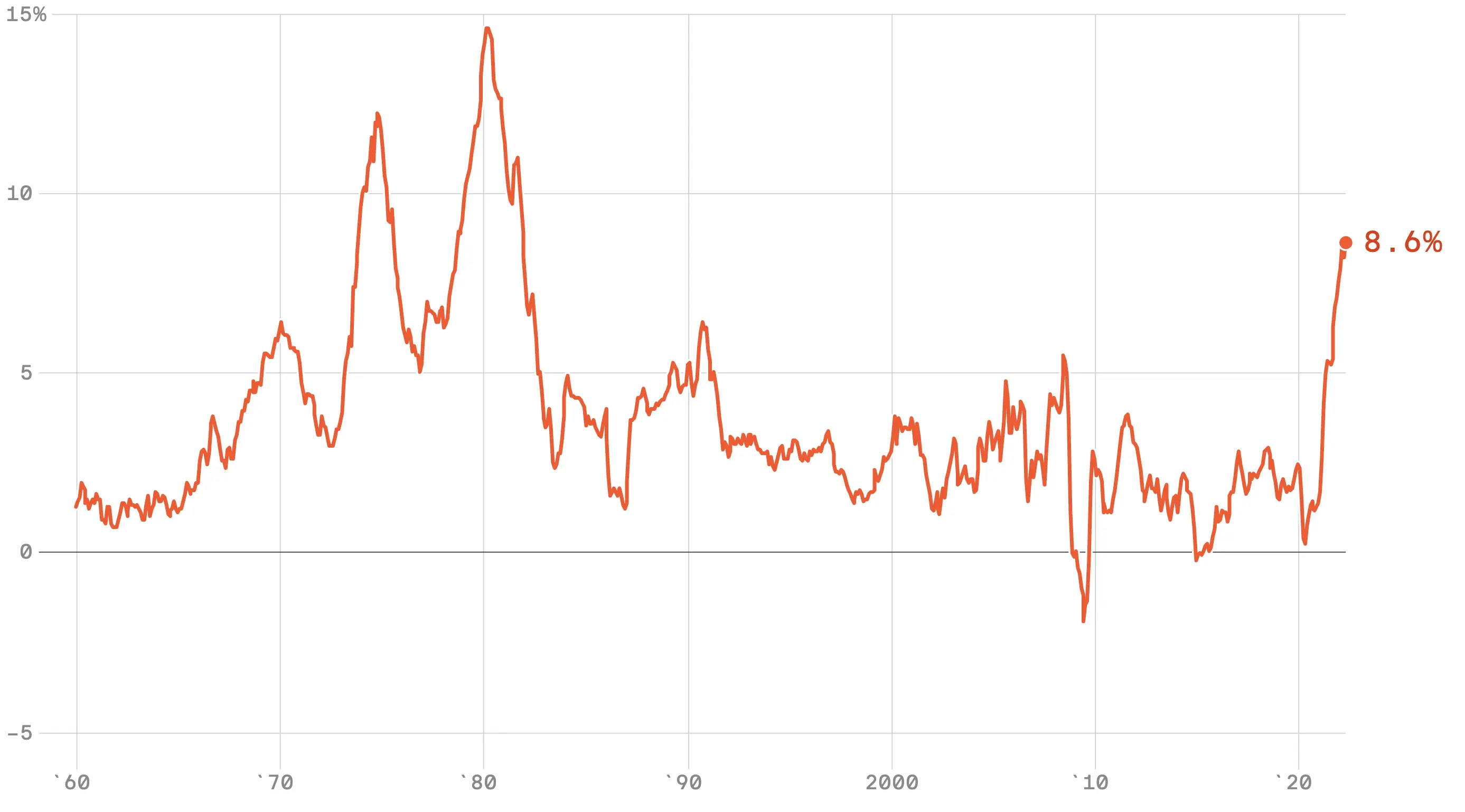

Inflation Hits Fresh 40-Year High in May 2022

As many Americans are surely aware, the price of goods in the United States has been on the rise. This issue has been blamed on many factors, including supply chain issues, the war in Ukraine, labor shortages, and more. Regardless of the reasons behind it, the upward trajectory has not stopped. In fact, the latest report from the Bureau of Labor Statistics shows inflation hitting a new four-decade high.

For the 12 months ending in May 2022, the Consumer Price Index rose 8.6%. As CNN Money notes, this marks the largest year-over-year increase since 1981. During the month itself, prices rose 1% after a relatively modest 0.3% increase in April.

The overall spike was led by commodities, such as gasoline. Last month, gas prices were 48.7% higher than they were this time last year. Furthermore, prices rose 4.1% according to the Index. Elsewhere, food prices have also outpaced the overall rate, growing 10.1% over the past 12 months. More specifically, “food at home” prices have grown 11.9%, including a 1.4% increase in May. Notably, these figures might not even include cases of so-called “shrinkflation” where companies choose to lower the portion sizes of their product rather than raise prices.

Following the BLS’s report this morning, the stock market reacted negatively. For a time, the Dow Jones Industrial Average had fallen as much as 800 points during the day while the S&P 500 is currently down more than 2.5%. The results also increase fears about the United States entering a recession.

As Loyola Marymount University economics professor and SS Economics president Sung Won Sohn told CNN, “The probability of a recession in the next year or so is rising. Inflation is eating away at consumers’ purchasing power.” Sohn added, “Since consumer spending accounts for about 70% of the economy, a real decrease in consumer spending would deal a big blow to the economy.”

While it comes as no surprise that inflation continues to be a problem, May’s report is seemingly worse than expected. Furthermore, unlike in some recent months, May saw prices rising across all CPI categories, with Aditya Bhave and Meghan Swiber of Bank of America Securities noting to Axios, “Stepping back, we are struck by the fact that there were almost no pockets of weakness in this report.” In turn, expect inflation to not only be a major economic issue in the coming months but also a political one as the midterm elections near.