Money Management Tips

How to Activate a Virtual Card Number on Apple Cash

In 2017, Apple expanded its FinTech aspirations by introducing a peer-to-peer payment account called Apple Cash. With this account, users could easily send and receive payments via iMessage. What’s more, while customers could elect to transfer received funds to a linked bank account, they could also be spent directly using Apple Pay. The only problem was that, for merchants that didn’t accept Apple Pay, there wasn’t a way to use your Apple Cash balance.

Well, that’s now changed. Recently, Apple introduced virtual card number capabilities to its Apple Cash account. So, if you’re curious about how to find your card numbers, read on!

Apple Cash: How to Get Your Virtual Card Number

Update your iOS

Before you can obtain a virtual card number for your Apple Cash account, you may need to update your phone/device. This new virtual card feature is only available to customers running iOS 17.4 or iPad OS 17.4. For iPhones, iOS 17 is supported on devices including the iPhone XR and newer (including iPhone SE generations 2 and 3) while the list of compatible iPad OS 17 can be found on Apple’s site.

Once your device is updated, your Apple Cash account will gain virtual card capabilities.

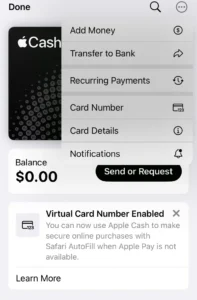

Finding your card number in Wallet

Next, head to Wallet on your device and select your Apple Cash card. Then, tap the three-dot icon in the upper right corner, and choose “Card Number.” When you do so, you’ll be able to see your card number, expiration date, and current security code (more on that in a moment). As a reminder, Apple Cash cards now operate on the Visa network.

With this number, you’ll be able to shop online with your Apple Cash card even if the retailer’s site doesn’t support Apple Pay. You may also be able to enter the card number manually in-store — although support for this will vary.

Requesting new numbers

Since your Apple Card card number is virtual, you are able to request a new one at any time. However, keep in mind that, if you’re storing your Apple Cash card on file with a retailer or subscription service, requesting a new number will likely mean you’ll need to update your info. Then again, depending on your intentions, you may decide not to do that (if you catch my drift).

In my experience, generating a new virtual card number took only a few seconds. Interestingly, after my new card number was created, the option to request another new card number was greyed out. But, after exiting back to my card and then returning to the Card Number interface, the option was once again available.

Regarding your security code

For extra security, Apple Cash notes that the security codes for its virtual card numbers will regularly update. In fact, each time you open your Wallet or use your virtual card on Safari, the three-digit security card will change. Furthermore, security codes will expire after 24 hours.

Even if Apple Cash may have lost its spotlight to the Apple Card and other Apple financial endeavors, there’s no question that the peer-to-peer account is still a useful tool — and one I’d say is actually underrated. Thus, I’m happy to see the account gaining some new functionality with this virtual card update. Granted, I wasn’t one of those in need of this feature, but I can appreciate that it’s now there.

By the way, for more on Apple’s various financial offerings, you can check out my reviews of the Apple Card, Apple Card Savings, and Apple Card’s financing options.