FinTech News

Healthcare Payments Startup Lynx Announces $17.5 in Funding

Oftentimes, when consumers consider what the term “FinTech” means, they picture neobanks, budget apps, and perhaps P2P lenders. However, the industry has continued to expand, with FinTech proving to be the basis for spin-off sectors such as insurtech. — which have gained popularity among users and venture capital firms alike. Now a company that blends finances and health care has “emerged from stealth,” announcing its latest investment rounds.

This week, Boston-based healthcare payments company Lynx announced it had raised $17.5 million to date. This stated funding actually includes a new $15 million Series A as well as a previously undisclosed $2.5 million seed round. The latest round was led by Obvious Ventures and .406 Ventures with participation from Frist Cressey Ventures. Winter Street Ventures, Shields Capital, and Huntington Avenue Ventures have also invested in the startup.

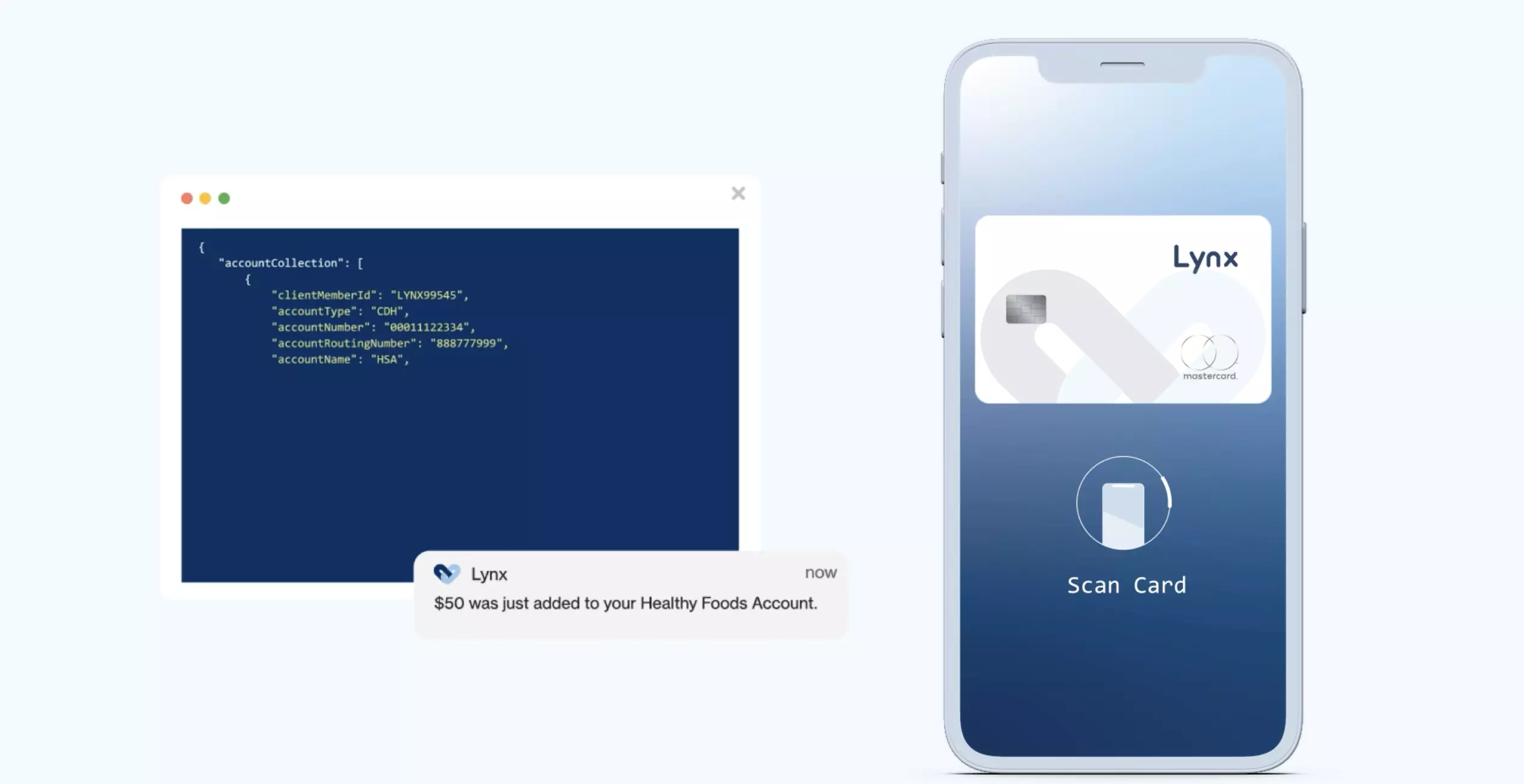

As Lynx explains on its site, the company is “introducing modern fintech to healthcare.” Using an API, companies can incorporate health payment solutions that the startup says can not only help drive health engagement but also enhance financial security for employees. Among the solutions Lynx notes is the ability for employers to encourage certain health activities by offering employees rewards that can be spent via a health marketplace. Meanwhile, Lynx manages both banking and healthcare challenges including compliance. Notably, Lynx also supports commercial health plans alongside Medicare and Medicaid.

Explaining the need for Lynx’s services in today’s world, the company’s co-founder and CEO Matt Renfro said in a statement, “Health and finance are inextricably linked for individuals. As a person’s financial status declines, their health status tends to follow, resulting in poor outcomes for both their wallet and personal health. Unfortunately, industry silos separating healthcare, financial services, and payments make it nearly impossible to empower people to improve their personal and financial health.”

Renfro continued, “The Lynx platform closes this gap between health and finance, offering a suite of best-in-class financial and e-commerce solutions via API for our enterprise partners, allowing them maximum flexibility to embed smart solutions directly into their customer experiences.”

Having quietly raised two rounds of funds before launching, it would seem that Lynx has their product pretty well thought out. Indeed, the platform definitely seems promising at a time when both employee benefits and health are top of mind for Americans. What’s more, Lynx looks to cast a wide net by offering an API that can be utilized by many different types of customers. For all of those reasons, the company could definitely be one to watch now that it’s officially put itself on the radar.