FinTech News

Galileo Introduces BNPL Virtual Card Solution for Banks, FinTechs

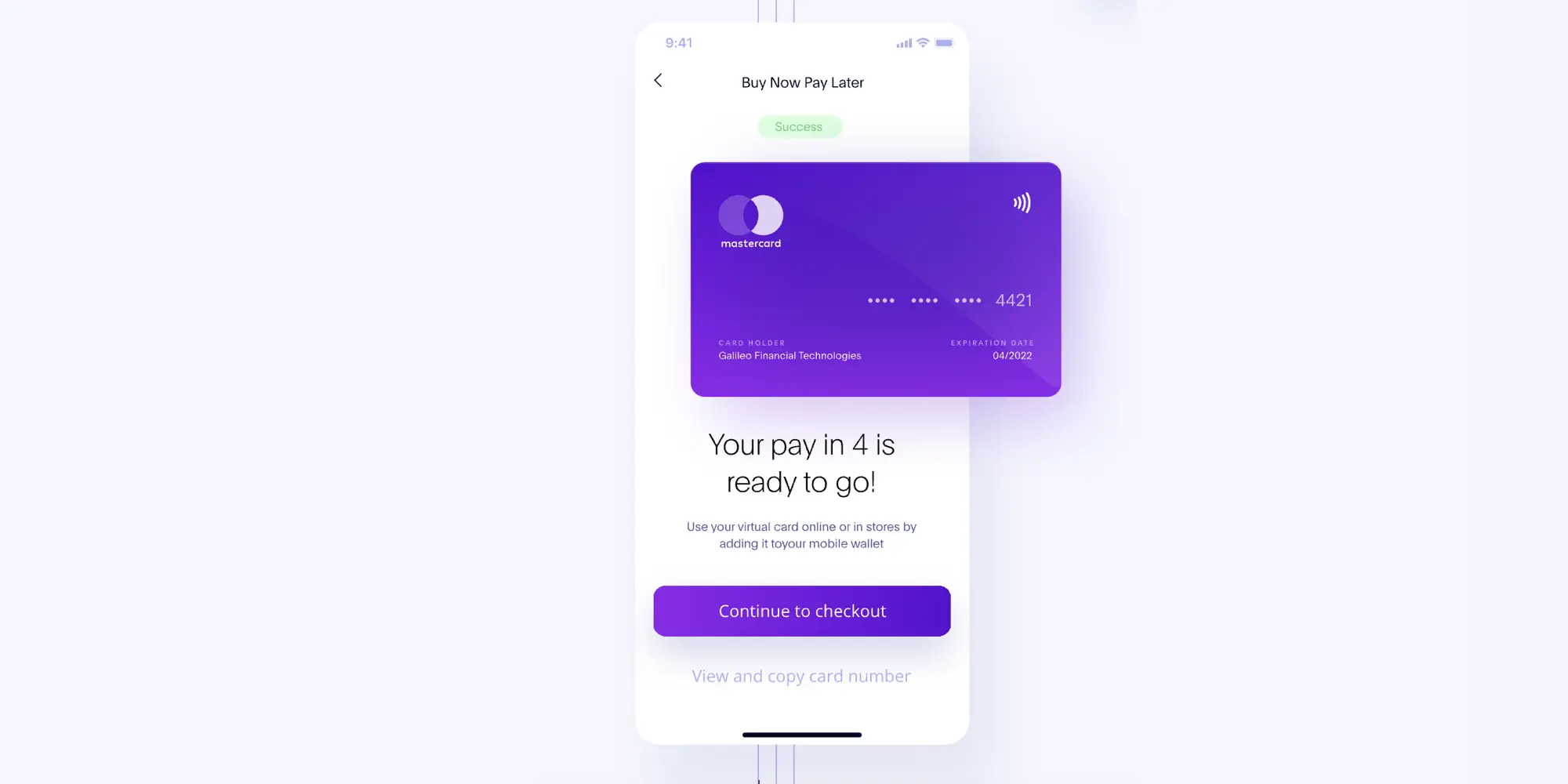

With the popularity of “buy now, pay later” platforms continuing to rise, the FinTech API provider Galileo has announced new functionality that will give banks and FinTechs an easy way to jump aboard the train. As the company explains, this new feature will enable institutions to issue single-use virtual cards for the purpose of buy now, pay later financing. This will allow banks and FinTechs to enter the growing BNPL market by offering a customizable service.

For example, institutions will be able to adjust the total number of installments and have the option of having payments reported to credit bureaus. Additionally, the banks themselves will make underwriting decisions. However, Galileo notes that they handle the servicing of the loan — including overseeing the payment schedule, payment processing, assessing any interest or fees, and more.

Walking through how the process will work, Galileo states that consumers will receive a real-time personalized offer for financing. Then, if accepted, the customers will be issued a single-use virtual card prefunded for the amount of their purchase. This card can be added to mobile wallets or used online at “most retailers.”

As noted, this latest expansion comes as the buy now, pay later market has grown considerably in recent years. In fact, Galileo cites a forecast that the number of BNPL customers could top 900 million globally by 2027. Furthermore, the industry has seen a number of new players entering the ring, including PayPal and, coming soon, Apple.

Announcing the new functionality, Galileo Chief Product Officer David Feuer said, “As more Americans are looking for flexible financing solutions, Galileo created a better BNPL experience that allows banks and FinTechs to make more valuable loan offers to their customers directly from their existing bank systems. Feuer continued, “For our clients who are already part of the Galileo ecosystem with checking and savings accounts, offering Buy Now, Pay Later makes it even more seamless for program managers to execute both payments and disbursements.”

There’s little doubt that Galilieo’s BNPL solution will see more institutions entering this growing market. Among them, it would seemingly only make sense if Galilieo’s parent company SoFi rolled out such a feature. At the same time, with regulatory scrutiny over buy now, pay later growing, we could see changes made to this platform and other services in the future. Until then, however, expect to see a lot more BNPL on the way.