Small Business News

Fyle Launches Real-Time Spend Management For Small Businesses

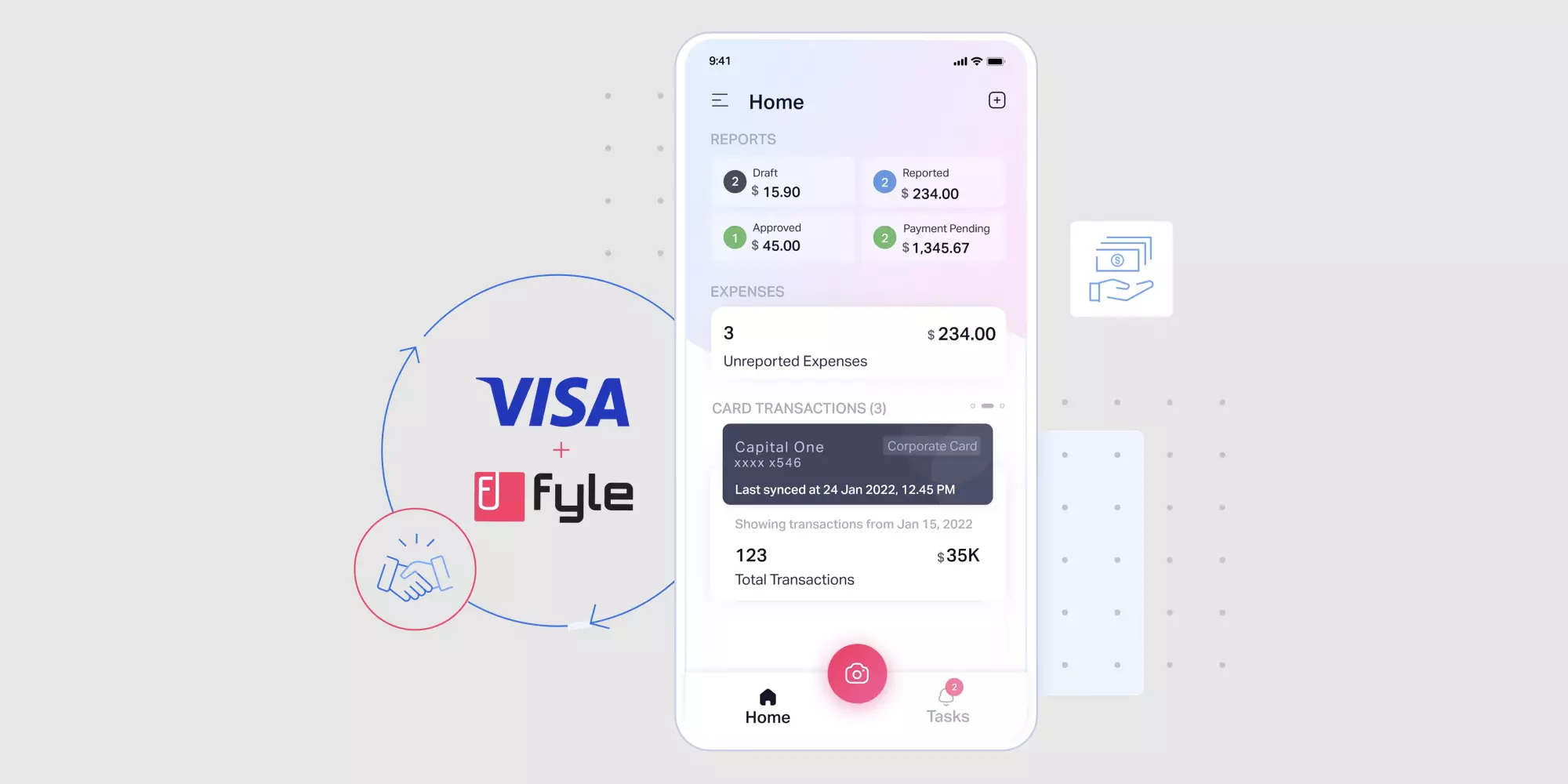

Small business owners who are seeking an easier way to keep track of their employee expenses spending and accounting may be interested to hear about a new addition to the digital bookkeeping platform Fyle. This week, the company announced the launch of a new tool that will help business reconcile their expenses.

As the FinTech notes, this new feature enables business owners to use existing credit cards to gain real-time spend management tools, rather than forcing them to obtain new corporate cards. The offering will first be offered exclusively for Visa-powered cards. This includes a number of popular options including the Chase Ink Business Cash, Capital One Spark Business, Chase Sapphire Reserve, and many more. Additionally, Fyle plans to add support for other card networks “over the next few quarters.”

According to Fyle’s website, as soon as a business card is swiped, employees will be prompted to submit a photo receipt via MMS while receipts can also be sent using Gmail, Outlook, MS Teams, Slack, or other common platforms. In turn, businesses can keep up to date with their accounting and expenses more easily. The platform will also be able to scan for receipts in email inboxes. Elsewhere, business owners can set budgets by project, category, or department and be notified when those budgets are being approached. Fyle also integrates with NetSuite, Sage Intacct, QuickBooks Online, or Xero — with support for Bill.com and Financial Force coming soon.

In a press release, Fyle founder and CEO Yashwanth Madhusudhan said of the new spend management platform, “With this launch, we can offer all customers who have Visa business credit cards access to powerful, AI-driven software to track & manage their card spending. It also gives us the opportunity to collaborate with card issuers who are losing business to new-age corporate card products.” Madhusudhan added, “For the first time ever, customers won’t have to switch their credit cards to get the best spend management experience.”

IDC Research Director for Financial Applications Kevin Permenter noted, “Fyle’s integration with Visa is very exciting as it offers their users the opportunity to utilize their own business cards in support of business spend management initiatives. Fyle’s ‘bring your own card’ approach has the potential to provide real-time insights, visibility and control to the millions of small businesses that use business and corporate cards as cash management tools.”

Although many FinTechs have jumped into the small business expense card space, Fyle’s solution could be more attractive to business owners as it allows them to keep using their favorite credit cards and keep earning rewards while still adding a smart and convenient expenses management tool to their routine. Of course, while Visa is one of the most popular payment networks, there may be business owners who prefer other options and may want to wait until Fyle rolls out support for these networks. In any case, this launch is one to keep an eye on and could be the solution many business owners have been looking for.