Personal Finance News

FTC Reports Funds Lost to Fraud Rose in 2018

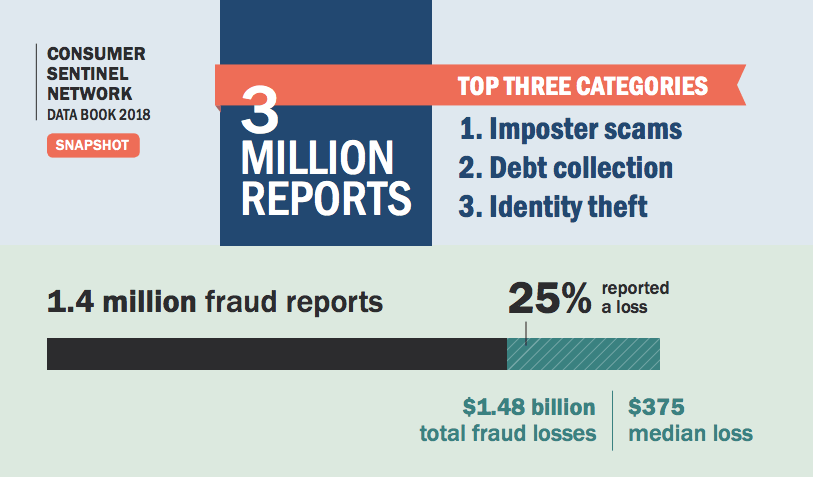

Do you know how to spot a scam? While certain forms of fraud such as the famous inhertance advance fee scheme e-mails may not fool many these days, it seems that thieves are still finding ways to take advantage of unsuspecting adults. In fact the Federal Trade Commission (FTC) found that reports of fraud and ensuing losses both increased last year.

According to the latest FTC report, the agency received 1.4 million complaints about fraud in 2018. Of those, about a quarter of complaint filers say they lost money due to these scams. In total these loses came to $1.48 billion. That marks an increase of 40% from just a year prior.

Making up the largest share of complaints were imposter scams, which accounted for 18% of overall reports. That amounts to over 535,000 incidents, with losses tallying up to $488 million. Some of the common scams in this category include individuals claiming to be from government authorities, family members in distress, or representatives for major businesses. Not surprisingly the most popular medium for such scams was the telephone, with 69% of fraudsters placing calls to victims. While only 8% of report filers fell for those fraudulent calls, lost funds still totaled $429 million with the median loss coming in at $840.

One of the more surprising statistics in the latest FTC report was that younger adults were actually more likely to lose money to scammers than older ones. The agency says 43% of complaints filed were by those aged 20 to 29 compared to just 15% from those ages 70 to 79. However median loses among older victims were higher, reaching $1,700 among those over 80 and $750 for those 70 to 79 compared to $400 for those 20 to 29. Of course, since this data comes from those who filed reports with the FTC, it may not tell the full story about who is being targetted by scammers the most — only who is reporting incidents more often.

In terms of where the most reports of fraud are coming from, Florida, Georgia, Nevada, Delaware, and Maryland were found to have the highest number of complaints per capita last year. Meanwhile, when it comes to identity theft, the list was slightly different, as Georgia, Nevada, California, Florida, and Texas made the top five.

As frightening as these figures can be, it’s important to note that there are ways you can help protect yourself against fraud and identity theft. For example individuals should monitor their credit reports and consider freezing said reports to help prevent new accounts being created in their names. Meanwhile, when it comes to fraudulent calls and e-mails, it’s always a good idea to double check the e-mail address or phone number of the contact before giving out sensitive information. Hopefully through education and vigilance the 2019 FTC report will show fewer Americans falling victim to scams and frauds.