FinTech News

Freelancer Financial Tool Able Raises $3.2 Million

A FinTech platform that looks to help self-employed creators and freelancers with their money has raised some of its own. This week, Able announced that it had closed a $3.2 million investment. The seed round was led by Elefund while Moonshots Capital, Next Coast Ventures, Signal Peak Ventures, and LocalGlobe also participated. With the funding, Able plans to expand its reach after launching its app earlier this year.

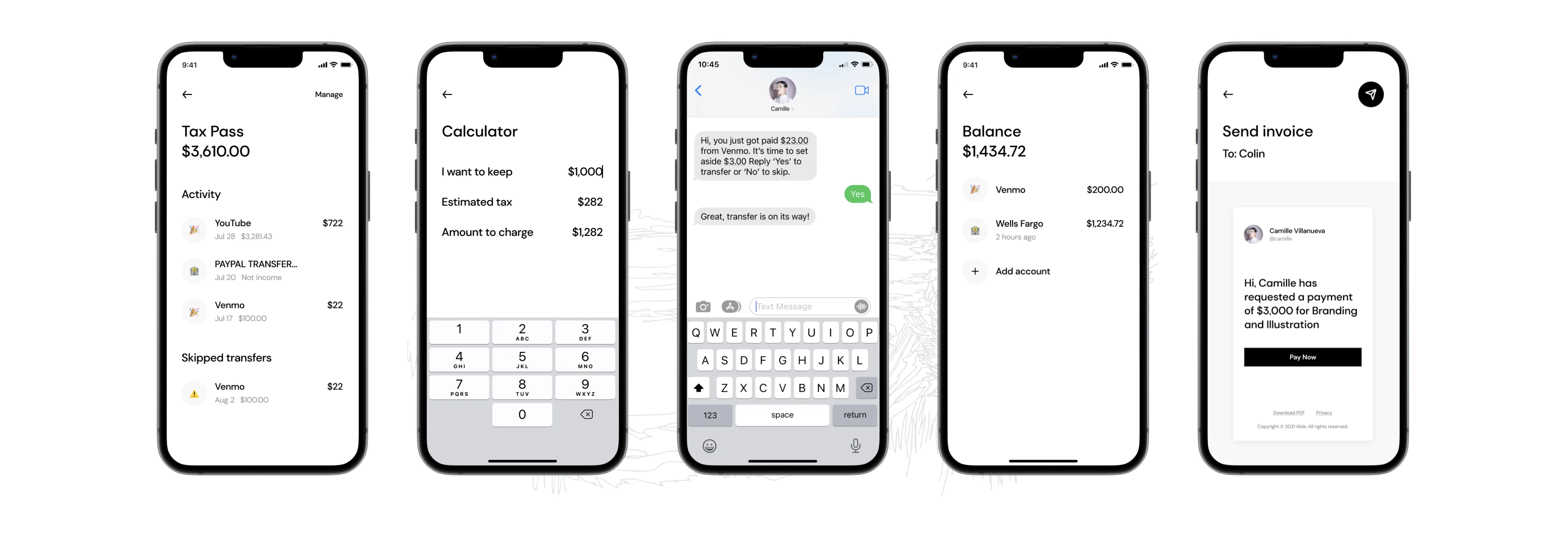

Able is a financial app aimed at helping freelancers to better manage their income, including helping them set money aside for taxes, generate quotes and invoices, view all of their funds in one place, and more. In particular, the service is directed at content creators such as YouTubers, Twitch streamers, etc. Speaking to the creator focus, YouTubers such as Phil DeFranco and Casey Neistat as well as YouTube co-founder Chad Hurley and Twitch co-founder Kevin Lin also participated in the investment round. As Able notes, the more than 30 creator investors have a combined total of more than 200 million followers/subscribers.

Speaking to the idea behind the app, Able co-founder and CEO Vince Cortese said, “Those who hone their craft, pursue their passion, and chase their dreams are shaping the future of work, but the current financial system views them as a risk, and the current rules and regulations make their lives needlessly complex. As a CPA dealing directly with independent creators and workers of all kinds, I have seen how managing money, getting paid, dealing with taxes, and accessing other financial products like credit and loans are all harder for independent workers. It’s time to change that.”

Echoing that sentiment, co-founder Angelo Pullen added, “Our purpose is not only to build the most effective tools to empower independent workers to manage their finances more simply, but also to celebrate those who choose to live a life without limitations. We are excited about this new generation of creators, makers, and freelancers, and those who believe freedom and security are one and the same.” Pullen concluded, “We love the idea of individuals choosing freedom in work, and we are committed to ensuring those individuals who pursue their passions are able to do so successfully.”

Incidentally, Able isn’t the only FinTech that has attracted investments from prominent YouTubers as of late. Previously, Phil DeFranco and Casey Neistat participated in a funding round for the investment app Public. Additionally, DeFranco recently announced an investment in Cred.ai, which is a debit card that helps consumers build credit.

With the creator economy continuing to grow, services like Able are likely to find a receptive audience. Furthermore, the platform counting YouTubers and Twitch streamers who are well versed in the needs of the product’s core audience could certainly be an advantage as they look to grow their market share. All in all, this is yet another example of an early-round startup that shows some real promise as we look to the future.