FinTech News

FinTron Announces Partnership with LendingClub Bank

Over the past few years, several FinTech firms have taken a stab at building a better banking account. In many cases, these startups are able to tailor the banking experience to better serve a specific type of customer. Yet, these bold ideas cannot become reality without the help of a licensed bank that can provide FDIC insurance to customers. With that in mind, this week, FinTron announced a partnership with LendingClub Bank to help power its digital banking platform.

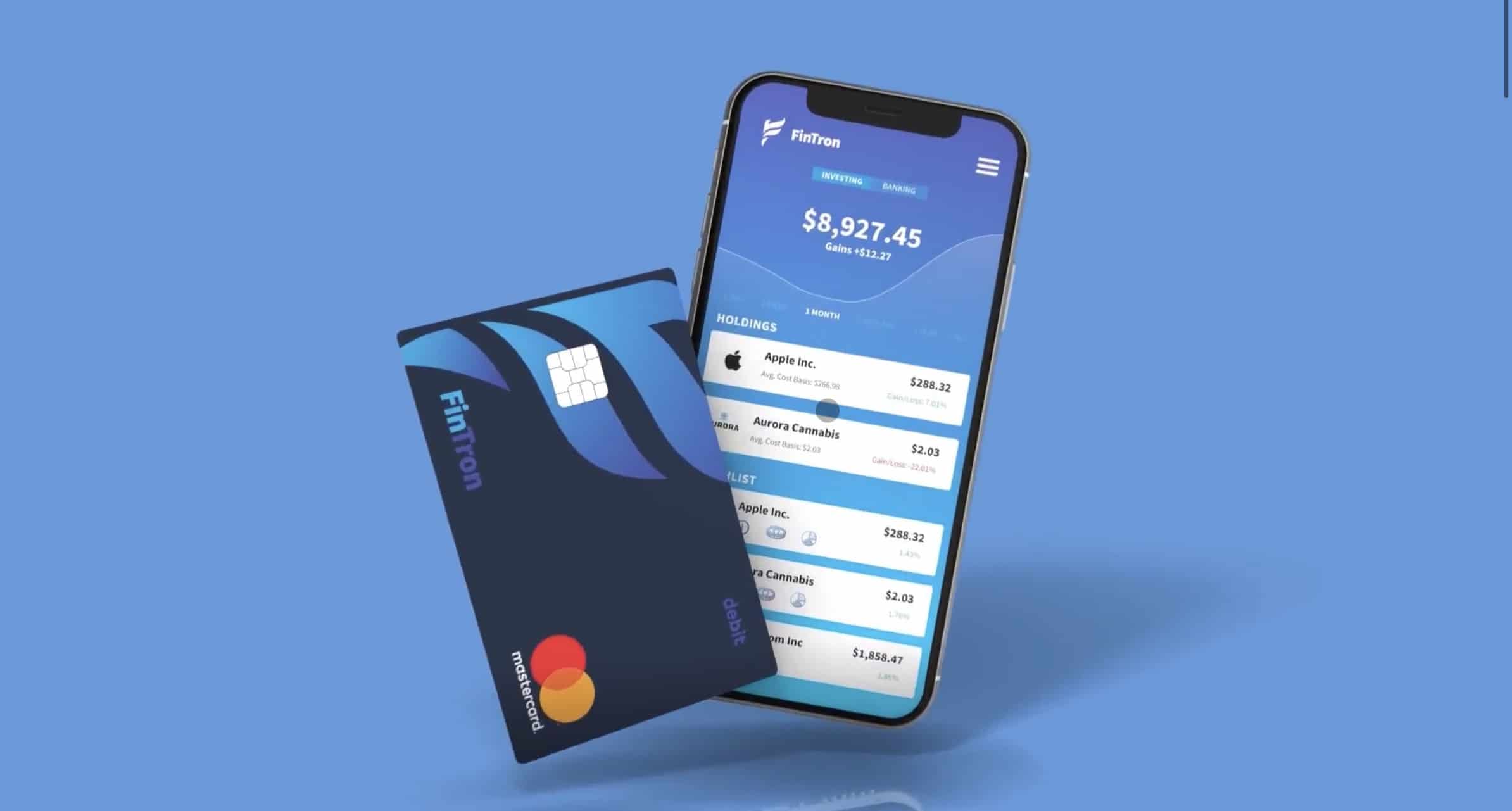

FinTron bills itself as a banking service built by and for the mobile-first generation. In fact, as its site notes, the company’s founders are all under the age of 25. As a result, the app aims to provide young customers with a comprehensive finance platform, combining digital banking, investing, and learning. For example, in addition to featuring personal finance articles, lessons, and quizzes, FinTron also includes a simulated stock trading game. Then, when customers are ready to invest for real, FinTron Invest will allow them to place commission-free trades, including support for fractional shares of select stocks and ETFs.

In terms of banking features, FinTron offers free worldwide ATM withdrawals, mobile check deposit, and more. Plus, the platform offers interest-bearing checking accounts. These features and more come at a cost of $2.99 per month.

Turning to FinTron’s new banking partner, LendingClub Bank is a subsidiary of the famed peer-to-peer lending platform LendingClub. The moniker is only a few months old, coming about following the FinTechs acquisition of Radius Bank. That deal officially closed in February of this year.

Speaking to how the banking partnership will benefit FinTron and its customers, the company’s founder and CEO Wilder Rumpf said in a statement, “LendingClub Bank’s extensive experience working with forward-thinking FinTech companies, and its mission of streamlining mobile banking to its customers, attracted us to the Bank. LendingClub Bank is an essential component to our seamlessly integrated mobile banking experience, rounding out our all-in-one investing, banking, and budgeting platform.“ Rumpf added, ”Our partnership with the LendingClub Bank team energizes us about what the future holds for our customers looking to build financial security.”

Even as some FinTechs such as Varo are applying to become national banks and others including LendingClub are acquiring banks of their own, there’s no doubt that the trend of startups partnering with FDIC-insured institutions will continue to grow. That said, as these arrangements do become more popular, it’s possible that regulators may be interested in taking a closer look at these partnerships to ensure that customers can still access their funds even if the startup depositing the cash on their behalf goes under. In the meantime, though, expect to see many more neobank platforms emerge — and keep an eye on FinTron as they bring financial tools and resources to Gen Z.