FinTech News

Fierce Emerges from Stealth Mode, Raises $10 Million

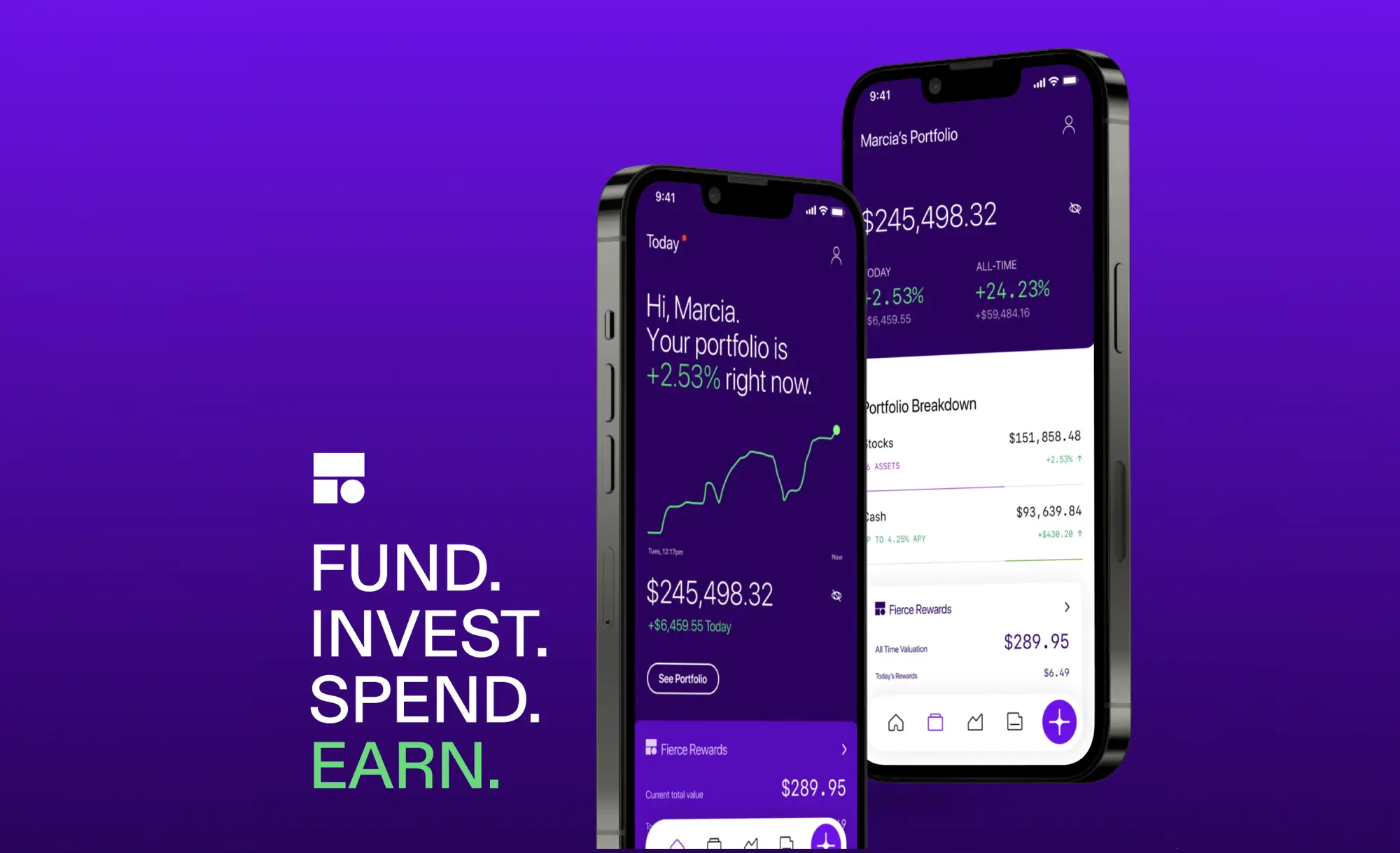

A FinTech startup that looks to help consumers manage their money from one place is making a splash as it emerges from stealth mode. This week, Fierce debuted its iOS app — with an Android app to follow later this year. On top of that, the company revealed that it had raised $10 million ahead of this launch. The seed round include participation from Pendrell, AP Capital, Wheelhouse Digital Studios, and Space Whale Capital along with a number of angel investors. With these funds, Fierece plans to hire more team members, work to acquire customers, and expand the reach of its app.

Fierce aims to be an all-in-one finance app that helps users get the most from their money. This includes offering an FDIC-insured deposit account (via a partnership with Cross River Bank) that currently earns 4.25% APY alongside stocks and crypto trading platforms. Additionally, the service includes a debit card that can be used at more than 55,000 fee-free ATMs that are part of the Allpoint network. According to their site, Fierce also plans to introduce a 1.5% cashback credit card in the future. Notably, with these products, any interest or rewards earned will be automatically redeemed to a user’s portfolio.

Offering a closer look at the app, Fierce founder and CEO Rob Cornish said, “Fierce is a customer focused, feel-good finance app. We are truly mission-driven in our effort to bring the best of FinTech to people, so we built an incredibly advanced platform with a simple UX to give as much yield as possible to our customers.” Cornish continued, “Our goal is to help users increase their wealth while enjoying an empowering, positive experience on the app.”

Meanwhile, angel investor David Krell said of the company, “As we’ve seen with some of the recent turbulence in the financial markets and incumbent institutions, the market is ready for a solution like Fierce, a company that puts customers first. Fierce is entering the market with a powerful solution that allows customers to take control of their finances while calming the financial anxiety that many people face today,” adding, “I’m thrilled to be a part of this journey with Fierce and the company’s relentless focus on helping investors across the country reach their financial goals.”

As far as FinTech debuts go, Fierce seems to be starting off on the right foot as it managed to exit stealth, debut its app, and announce an impressive seed round all in one day. It also helps that the platform’s banking services come from Cross River, which happens to be one of the top FinTech partner banks. With Fierce already planning expansions, including an Android app and a credit card, the company will definitely be worth keeping an eye on as it raises future funding.