Economic News

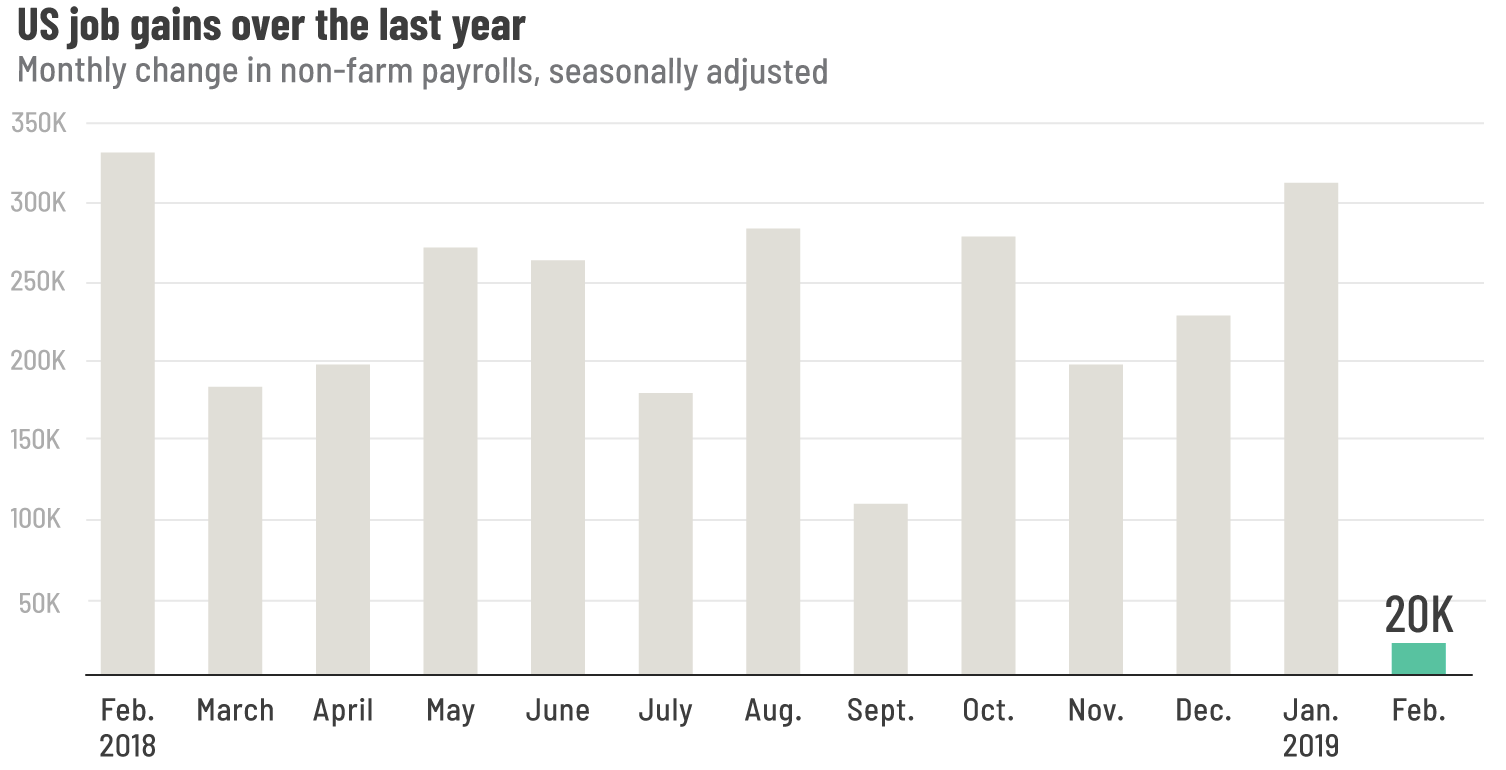

February Jobs Numbers Come In Low, Adding Just 20,000

Recent months have shown official job numbers well-exceeding economists expectations — but that was not the case in February. While estimates reported by CNN Business anticipated that data would show the U.S. economy added 180,000 jobs during the shortest month of the year, the Labor Department announced that it actually only added 20,000. That marks the lowest job growth month since September 2017. Nevertheless it was the 101st straight month of job gains.

Interestingly the latest ADP Employment Report, which was released earlier this week, showed payroll figures that were much more in line with economist estimates than the Labor Departments findings. ADP noted a gain of 183,000 nonfarm private sector employment jobs for the month. That includes an increase of 12,000 jobs among small businesses with fewer than 50 employees, 95,000 jobs at midsize companies, and 77,000 jobs from companies with more than 500 employees.

Despite the relatively low job growth for the month, the unemployment rate did manage to tick down a tenth of a point to 3.8%. According to the Labor Department, this decline was partially due to furloughed federal workers returning to their positions. Additionally CNN notes that the number of people working part-time due to economic reasons fell, suggesting employers may have transitioned part-timers to full-timers to fill open positions.

February’s job report has some speculating that the economy is starting to run out of workers. In fact CNN notes that, since June of last year, the Bureau of Labor Statistics has reported that there are fewer unemployed individuals than there are jobs available. On the other hand there are those saying the rough weather seen across the country — including snowstorms that made for treacherous travel — may have made February’s report a bit of a fluke. For example Raymond James chief economist Scott Brown told CNN, “This is pretty much a weather story. I wouldn’t worry about the payroll figure at all. I don’t think it tells us much.”

Obviously we’ll have to wait and see if February job numbers prove to be an outlier or a trend that ultimately leads to the now 101-month streak to end. In the meantime the report certainly isn’t helping to assuage fears that a recession is nearing. As a result expect more turbulence on Wall Street at least until March’s labor report is released.