Small Business Tips

Credit Strong for Business Overview

For small business owners, business credit can be a bit of a mystery. Not only are there separate business credit bureaus but they often have different scoring models than those consumers are familiar with.

Further complicating matters is that, in some cases, business owners will rely on their personal credit to obtain financing for their businesses, perhaps leading them to not even know that business credit exists. However, with Credit Strong’s latest product, Credit Strong Business, entrepreneurs have another option for building their business credit. What’s more, the offering recently received some updates.

With that, let’s take a look at how Credit Strong Business works:

What is Credit Strong Business and How Does it Work?

What is Credit Strong?

Credit Strong is a division of Austin Capital Bank that offers what are often known as credit-builder loans. However, despite the “loan” name, funds are not distributed to you upon approval of your application. Instead, they’re held in an FDIC-insured savings account while customers make set payments. Then, these on-time payments are reported to major credit bureaus, which in turn can help you establish, build, and improve your credit. Once all payments are made, the funds are released to you.

What is Credit Strong Business?

The basic idea behind Credit Strong Business is similar to what their consumer options offer except that, instead of using your personal Social Security number, you use your business’s Employer Identification Number (EIN), allowing you to build business credit. Additionally, instead of reporting your payments to the consumer credit firms, Credit Strong Business reports to other bureaus that track business credit.

What credit bureaus do Credit Strong Business report to?

At this time, Credit Strong Business Credit reports payments to Equifax, PayNet, and SBFE — three of the major business credit bureaus. However, in the future, the company plans to also report to Experian and Dun & Bradstreet.

Requirements for Credit Strong Business

According to Credit Strong, Business applicants must:

- Have an EIN

- Not be in the agriculture industry

- Be an LLC, corporation, or general partnership

- Own at least 25% of the business

- Be registered with the Secretary of State for at least 3 months

- Be located in the United States and have a physical U.S. address place of business

Credit Strong for Business Plans and Pricing

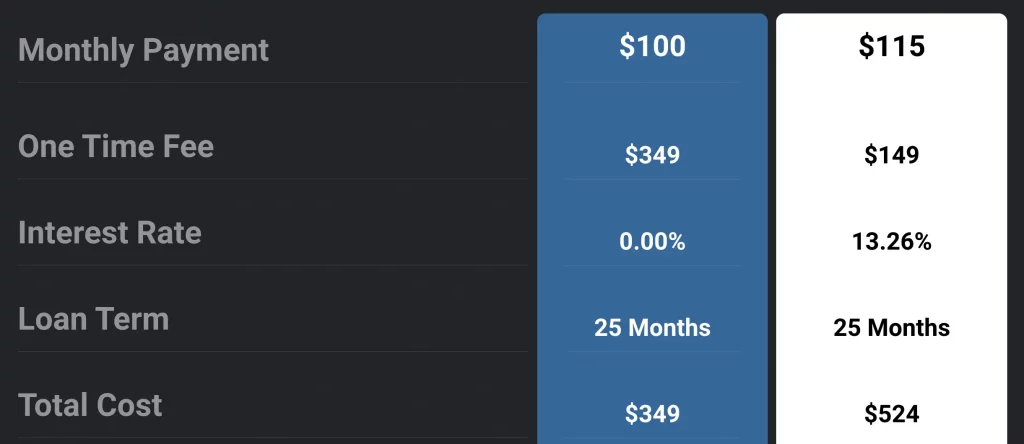

Currently, there are six Credit Strong for Business Plans, all of which feature payments over 25 months. First are a pair of plans that report as a $2,500 loan to credit bureaus. Business owners can choose to make monthly payments of $100 a month after a one-time payment of $349 or can opt for a lower $149 upfront fee and make payments of $115 instead. While the $100 a month plan has an interest rate of 0% (excluding the one-time fee), the latter option works out to an interest rate of 13.26%.

Next up are two $5,000 installment loan options. Here, there’s a $200 a month fee option with a $549 one-time fee or a $220 a month option with a $199 upfront fee. Like with the previous plans, the option with the larger initial fee has 0% interest compared to an 8.96% interest rate for the lower one-time fee plan.

For those wanting an even larger account size, there are also two $10,000 account plans. In this case, customers can pay a $749 one-time fee and make monthly payments of $400 or pay $149 upfront and $440 per month. Once again, these plans have interest rates of 0% and 8.96% respectively — not including the one-time fee.

With any of these plans, business owners can cancel at any time without penalty. To do so, customers can simply pay the outstanding interest and loan balance. Alternatively, Credit Strong advises that users can contact their support team.

Overall, Credit Strong Business is an interesting way for small business owners to build business credit. Additionally, once the loan is paid off, entrepreneurs will be able to access the principal amount. However, on that note, it’s important that businesses consider the costs associated with Credit Strong’s service as well as ensure that they can afford the monthly payments — especially since late or missed payments could hurt their business credit. That said, with the newer 0% interest rate plans, it can be easier for customers to know exactly how much they’ll be paying for the service. To learn more about Credit Strong Business or to apply, be sure to check out their site.