Personal Finance

Credit Card Confidence Increased in April

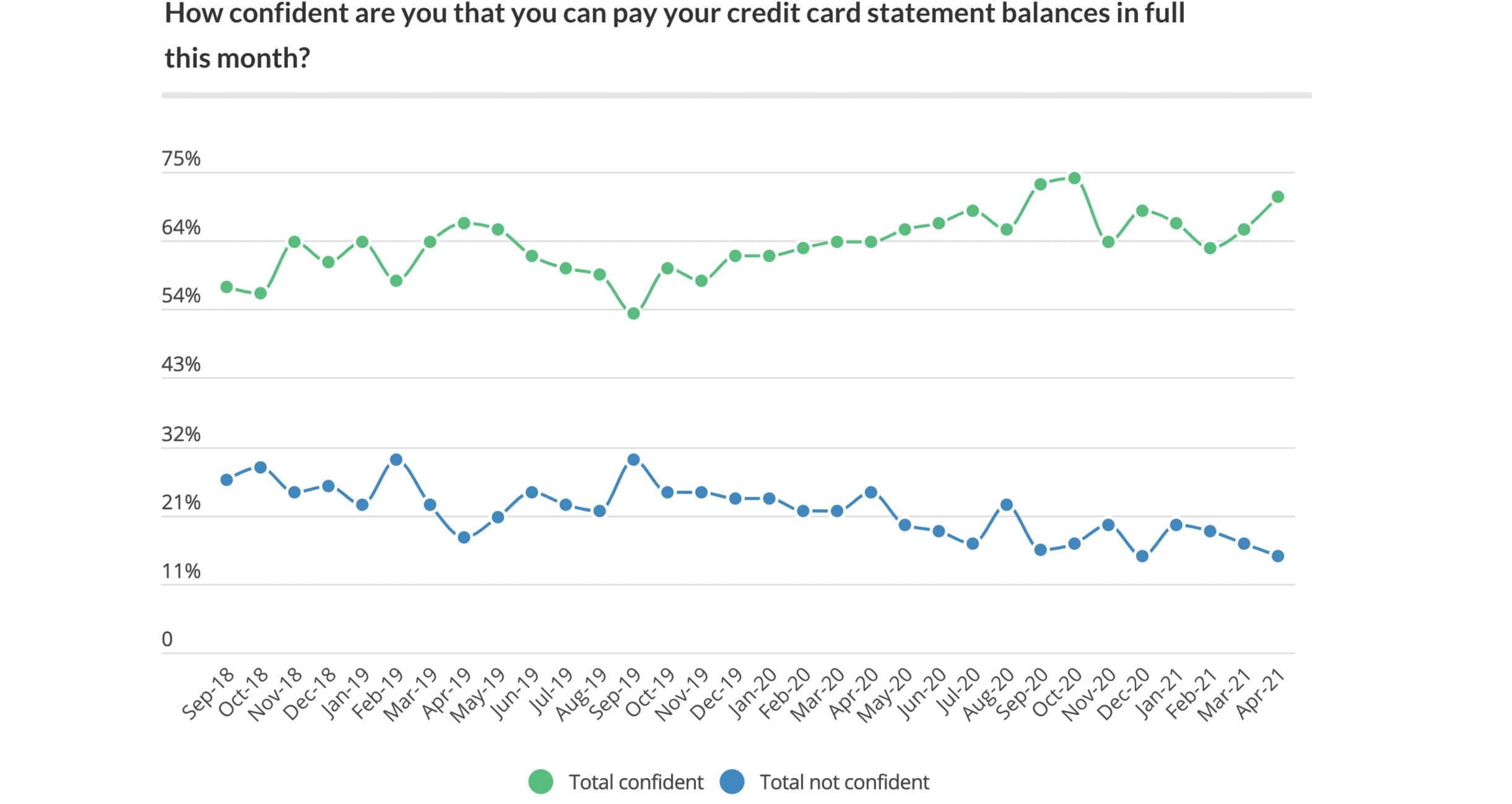

It seems as though a greater number of Americans were prepared to pay off their credit cards last month than they have been at any other point so far this year. The latest update to LendingTree’s monthly index shows credit card confidence once gain on the rise. During the month, 71% of those surveyed stated that they would definitely be able to pay off their credit card balance in full. This was not only up five points from March and seven points year over year, but also represents the third-highest confidence level ever recorded by the index, topped only by September and October of last year when the percentage reached 73 and 74 respectively. Meanwhile, only 15% said they were totally not confident about paying off their monthly balance in April. That ties a record low last seen in December of 2020.

Interestingly, while there’s still a gender gap in the index, as men are more likely to express credit card confidence than women, that gap shrunk in April. In fact, with 68% of women surveyed stating that they were totally confident in paying off their balance, the month marked a record high. What’s more, the figure represents a seven point increase from the month prior and a significant 11 point jump from this time last year. The seven-point differential (with 75% of men stating confidence) was also the smallest gap observed by the index.

While these latest figures may feel like a bit of deja vu following new highs last year that gave way to a drop off, LendingTree Chief Credit Analyst Matt Schulz suggests we’re unlikely to see a repeat of that. Schultz explained, “There’s no reason to expect cardholder confidence to fall sharply anytime soon. As the economy generally improves, there’s likely to be a sense of relief for many people just to be able to spend again like they did before the pandemic took hold.”

To Schultz’s point, long-term confidence was also on the rise. Of those surveyed, 44% said they expected to pay off their full credit card balance each and every month for at least the next six months. This also marks a record for the index and was up three points from the month prior.

Overall, April’s installment of LendingTree’s Credit Card Confidence Index shows a lot of hope as Americans look to overcome the financial effects of the pandemic. Even as questions arise about the larger economic recovery following last week’s weak jobs report, this survey would suggest that many consumers are getting a handle on their personal finances. Hopefully this is a trend that continues and brings this confidence index even higher.