FinTech News

Car IQ Raises $15 Million to Expand Vehicle Payment Platform

A FinTech that helps turn fleet vehicles into payment tools has just raised a new round of funds. This week, Car IQ announced that it had raised $15 million. The addition to their Series B (which was initially announced in 2021 and amounted to $15 million at the time) was led by Forte Ventures while existing investors including State Farm Ventures, TELUS Ventures, and Avanta Ventures returned to participate. New strategic partners also joined including Visa, Bridgestone, Navistar, and Circle K.

To date, Car IQ has now raised a total of $42 million including the previous half of the Series B and a $6 million Series A in 2019. According to the company, the latest funds will be used to help accelerate the expansion of their payment platform amid increased demand. The startup also intended to introduce additional commerce categories such as electric vehicle charging, repairs, insurance, and vehicle registration.

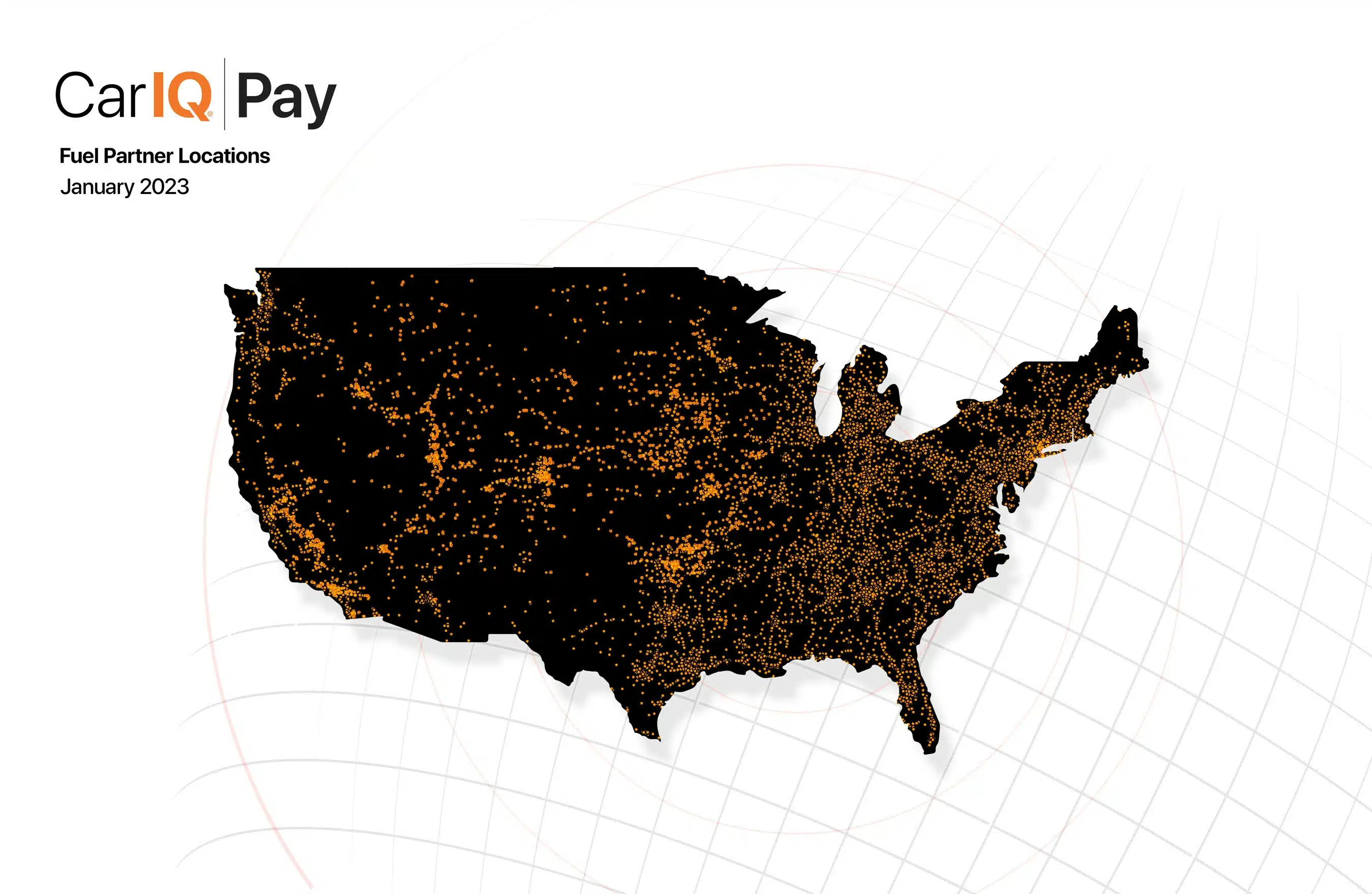

Car IQ is a FinTech that seeks to connect vehicles with banks and service providers, enabling card-free payments. In fact, their Car IQ Pay platform allows commercial fleets to pay for fuel, tolls, and other experiences automatically. For example, at equipped stations, customers only need to select the pump number in order to pay for their fuel. According to the company, the service can help these fleets to better manage their funds, while also gaining insights and preventing fraud. Currently, Car IQ Pay is accepted at more than 21,500 gas stations across the country, with such chains as Shell and Sunoco already participating.

Commenting on the latest round, Car IQ CEO Sterling Pratz said in a statement, “These funds will allow us to move faster and meet the market demands from fleets in the commercial and OTR trucking spaces.” Pratz continued, “Incorporating vehicle data to the payment transaction is a game-changer: we can determine what the vehicle needs before it buys, validate the purchase after the fact, and make the experience for the driver completely frictionless.”

Forte Ventures partner Louis Rajczi said of the firm’s investment, “Car IQ continues to excel in today’s challenging economic climate. The company’s patented technology, ability to attract strategic investments from major FinTech and automotive companies, and high-level commercial partnerships are laying the groundwork for rapid growth of their vehicle payment solution.”

With Car IQ’s technology already being adopted by a number of large fuel station chains, it’s easy to imagine the other applications the service could add to its ecosystem. In turn, it’s really no surprise that investors would see value in the firm. What’s more, with the latest round also bringing strategic partners on board, the company seems well-positioned for further growth. This also begs the question, if the fleet product continues to be successful, could a wider consumer-facing product follow? While that may be a ways away, there’s no question that, with these fresh funds in its tank, Car IQ is accelerating forward.