FinTech News

Brex Pivots Away From Small Business Customers, Toward Startups

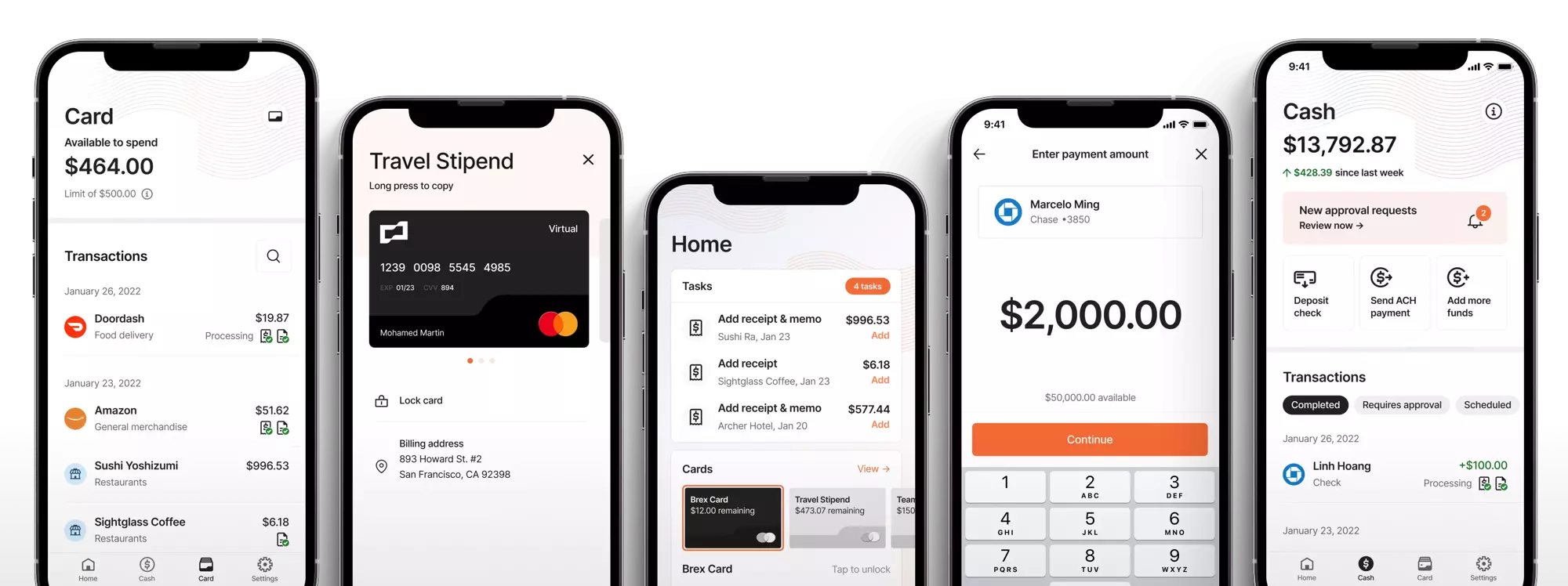

A FinTech on the rise has announced a major shakeup that will see them actively repelling many current customers. Last week, Brex revealed that it was moving away from serving general small businesses and would instead refocus its platform to serve startups — specifically those who have already received venture capital or other funding. The company has already been sending emails to affected customers, informing them that their accounts will be shut down as of August 15th.

In their FAQ about the move, Brex wrote, “We can no longer serve small business customers that are not pre-seed or have not received venture funding. However, if you are currently fundraising or plan to fundraise, or are part of the startup community (crypto, angel investor, VC, etc.) please reach out.” Meanwhile, in a Twitter thread detailing the company’s decision, co-founder and co-CEO Pedro Franceschi stated, “We know how painful it is to switch financial services in a moment like now, and we’re giving customers two months to migrate. We’re also working with all affected customers to make this process as smooth as possible.”

As TechCrunch recalls, Brex was originally founded as a corporate card solution for startups as well as small businesses. In turn, a majority of the firm’s revenue came from interchange fees collected when customers utilized their debit cards. However, more recently, Brex has made a push into software-as-a-service as a means of diversifying its revenue while building better tools for its users. With these efforts, the company has been gaining significant investment, raising a $300 million round earlier this year, which valued the FinTech at $12.3 billion. To date, Brex has raised a total of $1.5 billion.

Notably, some of these funds went toward attracting small business customers with bonuses and similar incentives. Brex’s other co-founder and co-CEO Henrique Dubugras acknowledged as much, telling CNBC, “It’s terrible. It’s the worst outcome for us, too. We invested so much money in acquiring these customers, serving them, building the brand, all these things.”

Brex’s decision has seemingly left an opening for other FinTechs to make their move and attract so-to-be-former Brex customers. Among them, Relay Financial has launched a promotion directly targeting affected small business owners, offering them $150 for switching to their service. This bonus is valid as long as new customers deposit at least $1 and share proof that they are being impacted by Brex’s pivot by sending a copy of their account closure notice to the firm.

This move from Brex is the latest example of less-than-stellar news coming from the FinTech industry. In addition to several cryptocurrency firms enduring what’s been dubbed the “crypto winter,” other startups have recently reported decreased valuations. Of course, this comes as the United States economy as a whole is seemingly at a turning point. Ultimately, while Brex’s decision is certainly surprising and does seem foreboding in the greater context, this pivot doesn’t mean that the FinTech as a whole is bound for a correction after a record-breaking year — although things could definitely get interesting as the second half of the year unfolds.