FinTech News

Bankjoy Raises New Funding From Curql Collective

A FinTech that brings enhanced digital experiences to a variety of financial institutions has garnered new investment. This week, Banjoy announced it had raised a new round of funding led by Curql Collective — a Credit Union Service Organization that looks to bring FinTech innovation to credit unions. The amount of the venture round was not disclosed. Excluding these funds, the company had raised $14.3 million to date, $12.5 million of which came from a Series A round closed in October 2020.

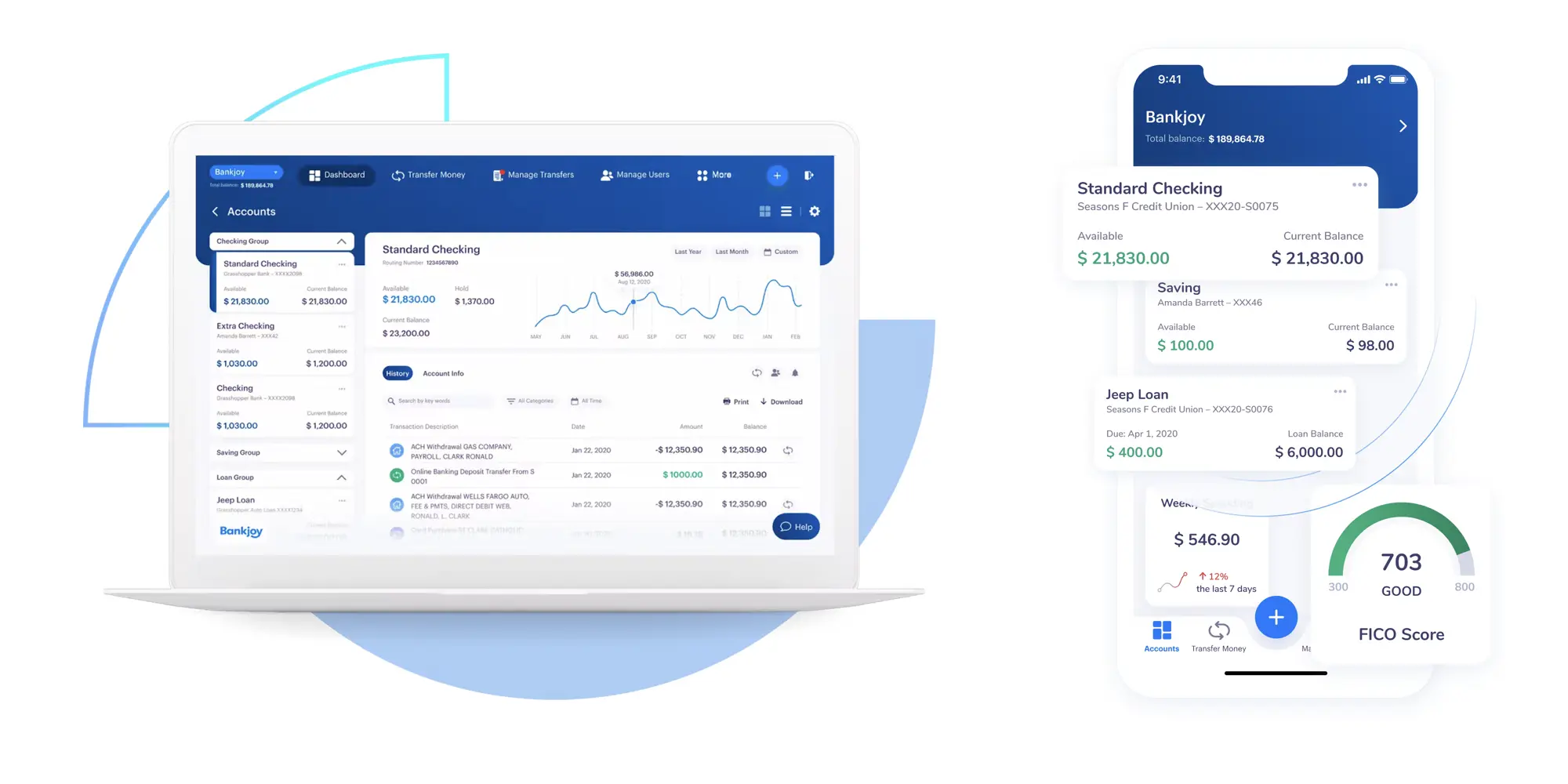

Bankjoy is a Detroit-based firm that offers digital banking products to a variety of institutions. Among the solutions it features are mobile and online banking, online loan applications, Conversational AI, and more. Additionally, last month, Bankjoy announced the launch of “Online Account Opening 2.0,” which it says provides a better onboarding experience for banking customers and clients. According to the company, it currently has more than 60 financial institution clients across the country.

Commenting on the state of digital banking in general, Bankjoy CEO Michael Duncan stated, “As we see interest rates continue to rise, competition for deposits will likely intensify over the next 12 months among financial institutions and these trends will influence the digital transformation strategies for community banks and credit unions. Online and mobile banking apps have a serious impact on member and account holder satisfaction.”

On that note, Duncan added, “We are thrilled to bring Curql on as an investor as Bankjoy continues to grow, as this latest round of funding will allow us to pursue new opportunities to redefine the digital banking experience and help more community financial institutions thrive in an increasingly competitive environment.”

Meanwhile, Curql Collective President and CEO Nick Evens said of the investment, “We are proud to invest in Bankjoy, as we believe the right technology can positively impact how credit unions engage with their members and how members engage with their money. We look forward to supporting Bankjoy’s next growth phase and helping more forward-thinking credit unions deliver digital banking experiences that exceed their members’ expectations.”

Although the amount of money invested is typically what’s focused on when it comes to funding rounds, in the case of this latest Bankjoy raise, it’s clear that the firm is viewing this as a strategic partnership more than just another venture round. That makes a lot of sense as the association between the two could definitely yield positive results for all involved. Elsewhere, this news once again highlights the trend of “behind-the-scenes” FinTech platforms proving to be among the fastest growing, while consumer-facing ones have faced more challenges. While the amount of money Bankjoy raised may one day be revealed, for now, it seems as though it will be more than enough to fuel its continued growth.