FinTech News

Banking API Startup Teller Raises $4 Million

It may only be January but 2020 is already shaping up to be an interesting year for FinTech. This includes big acquisitions, partnerships, product releases, and more. Now comes news that an import startup with its sights set on an omnipresent incumbent has just raised funds to fuel their plans.

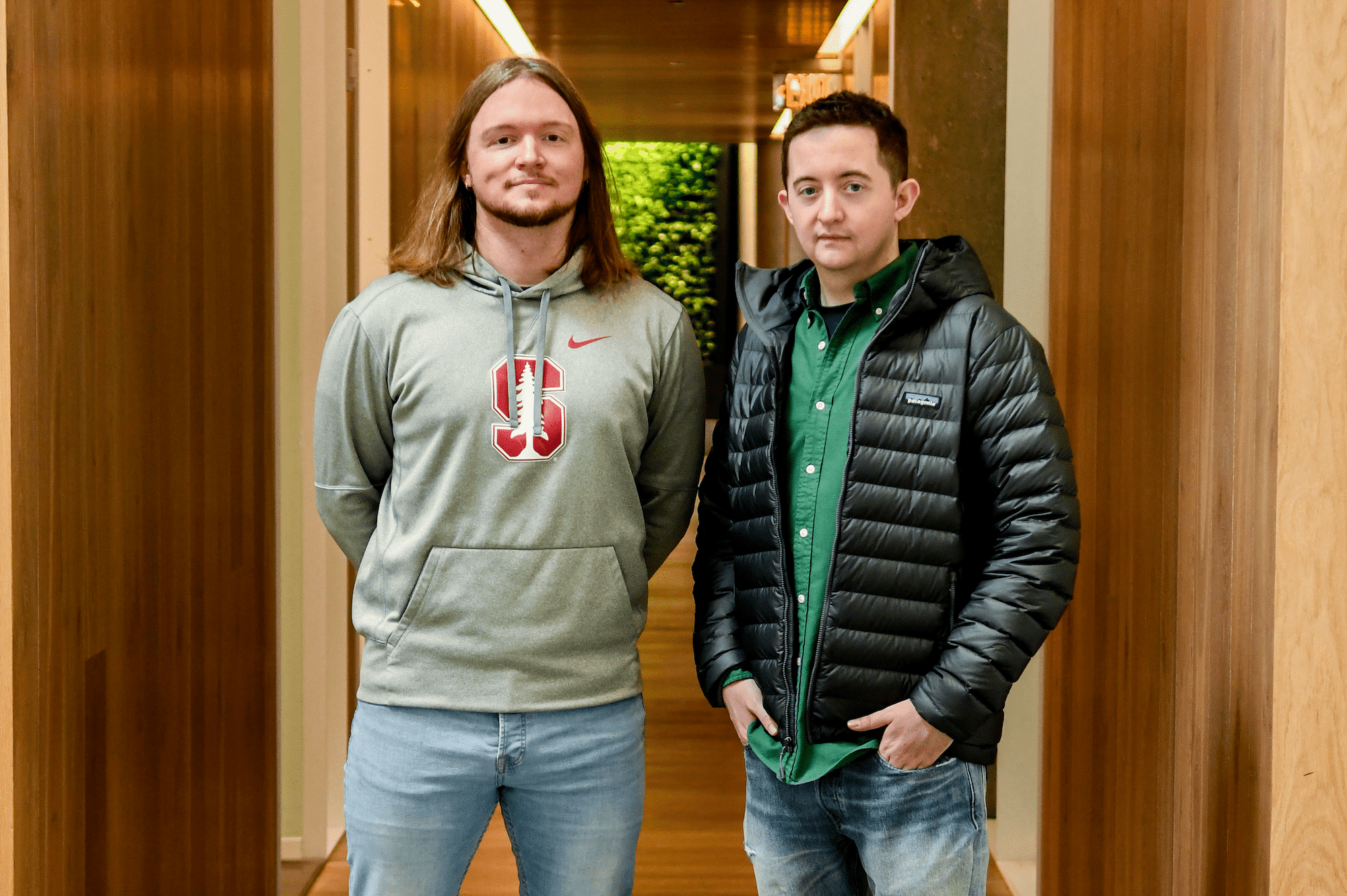

As TechCrunch reports, Teller — a FinTech startup not to be confused with the mute magician — has closed a $4 million seed round. Investors participating in the round include Lightspeed Venture Partners, Founders Fund, and SciFi. Notably those are all United States-based firms as Teller has reincorporated stateside after essentially being forced to flee its native United Kingdom due to tight regulations. The startup’s co-founder Stevie Graham explained to TechCrunch, “[Payment Service Directive] PSD2 was also a factor in our decision to withdraw from the U.K. Primarily because it made practically every use-case of banking APIs a regulated activity, meaning that it’s no longer possible to quickly build and test a product without first spending thousands of pounds and 3-6 months getting FCA approval.”

In entering the U.S. market, Teller will now compete with the similar service Plaid, which Graham says is now “effectively a monopoly.” Funny enough, news of Teller’s seed round comes shortly after Visa announced that it would acquire Plaid for $5.3 billion. Asked about the purchase, Graham expressed doubt in Plaid’s ability to continue innovating, saying that Visa is “not exactly renowned for … shipping successful developer products.” He went on to theorize that some employees of the company might want to jump ship, remarking, “The top talent at Plaid has to now be sitting there in the morning thinking ‘do I really want to work at a stodgy public company that has barely 3x’d its stock price in five years? This is not what I signed up for.’ This is why I fear for the future of Plaid’s product. A lot of their best people will be heading for the door, and we’d love to talk to them.”

While it’s clear that Teller’s team is feisty and hungry for a shot to complete with Plaid, the head start the latter has enjoyed will certainly be a major factor. Then again Graham does have a point in suggesting that not all startup acquisitions yield great results. So could Teller become the new big name in FinTech? We’ll have to wait and see.