FinTech News

Automated Finance App Tally Raises $50 Million

When Silicon Valley looks at FinTech, they still see dollar signs. At least that’s what the recent string of investments would suggest, with the automated finance app Tally being the latest recipient. As Fortune reports, the app has just closed a $50 million funding round.

The Series C round was led by Andreessen Horowitz (a16z) with additional participation from previous investors Kleiner Perkins, Shasta Ventures, Cowboy Ventures, and Sway Ventures. This latest round more than doubles Tally’s previous funding, bringing its total to $92 million. According to Tally, the cash will be used to continue their goal of automating consumers’ finances, saving them time, stress, and money.

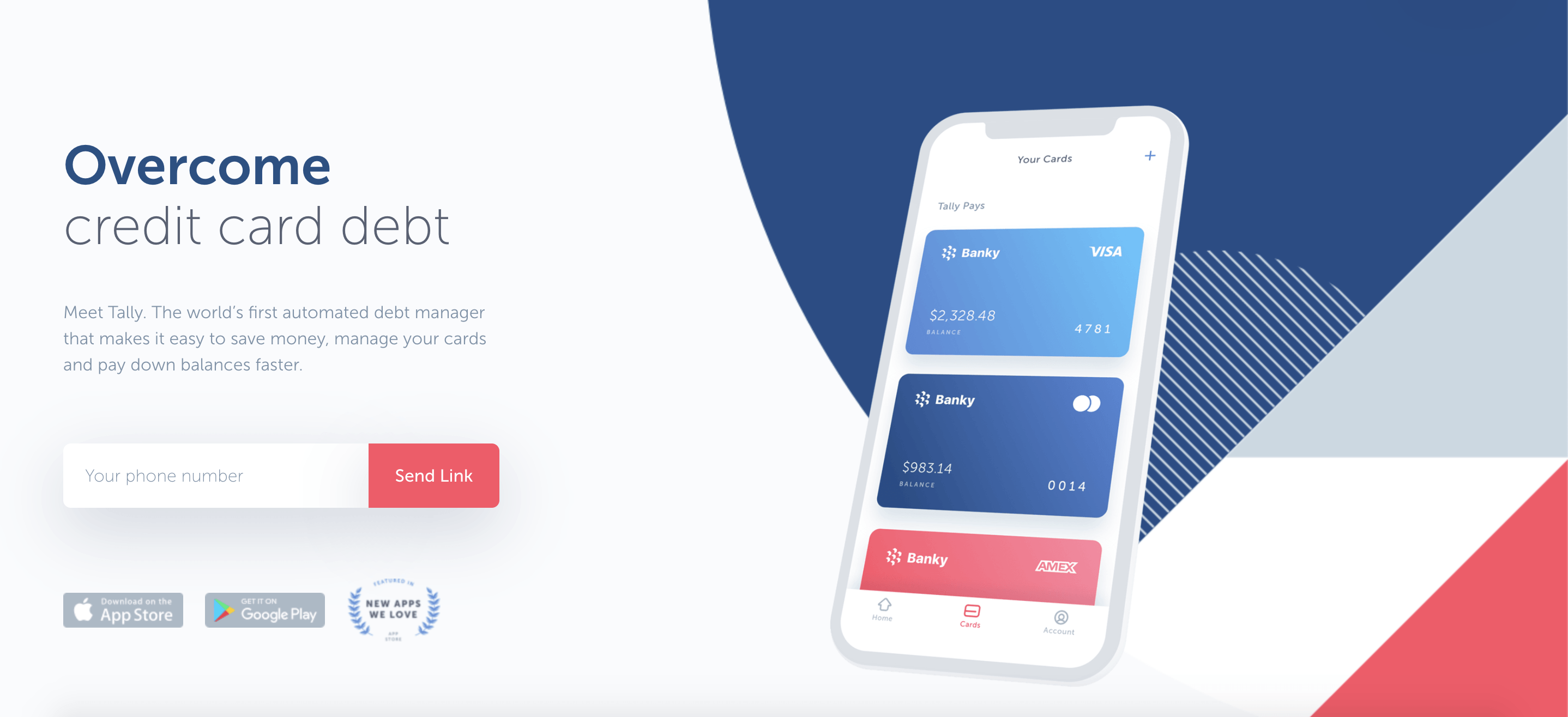

Tally’s main service offers users an automated solution to pay off their credit card debt. First, the app will look at the balances and interest rates on a customer’s current credit cards. Then the service will offer them a line of credit and begin making automated payments to the cards on their behalf, allowing users to make a single payment to Tally each month. Beyond this consolidation service, Tally is also gearing up to launch its Tally Save product, which will reward users for saving.

Following Andreessen Horowitz’s investment in Tally, the firm’s general partner Angela Strange will join the app’s board. Speaking to why a16z choose to fund Tally, Strange said, “We take automation for granted in so many areas of our lives, but automation has been slow to come to financial services. Too many Americans are drowning in credit card debt, in large part because the system is too complex — by design. Tally has built trust with consumers as their automated debt manager, a first but significant step towards providing that full financial roadmap, and putting billions back in consumers’ pockets.” She concluded, “We are thrilled to be partnering with the Tally team.” Meanwhile, in a statement, Tally co-founder and CEO Jason Brown elaborated on this company’s vision, saying, “Tally’s end goal is to automate people’s entire financial lives. We are excited to get the backing of a16z to provide a service that makes optimum financial decisions for people based on their objectives — and then actually takes action on their behalf to see those goals through. We believe this is the future, and we are excited to deliver this new and improved approach.”

As mentioned, Tally’s Series C is merely the most recent funding round FinTech has seen in recent months. In May Zero raised $20 million for its credit-debit hybrid, while the purchase financing platform Affirm had a monster $300 million round in April, putting it just shy of “minotaur” status. So who will be next? That may be hard to say for sure but one thing is certain: it’s a good time for FinTech.