Kyle Burbank

Head Writer ~ Fioney

Kyle is the head writer for Fioney. He is a personal finance nerd, constantly looking for new apps and services to test and incorporate into his own financial game plan.

In addition to his role at Fioney, he's written for other publications including Born2Invest, Lifehack, and Laughing Place, as well as his own site Money@30. He also creates personal finance and travel-related videos for Fioney's YouTube channel, which has garnered more than 2 million views.

Currently, Kyle resides in Springfield, Missouri with his wife of 10 years. Together, they enjoy traveling (including visiting Disney Parks around the world), dining, and playing with their dog Rigby.

Personal Finance

Building Credit By Including Your Rent Payment History

by Kyle Burbank

Every month, millions of Americans pay their rent in full and on time — and shouldn’t that count for something? Instead, with while credit reports and scores often factor in payments made on loans, credit cards, etc., rent payments are typically excluded. However, that is starting to change. This is actually an issue that now Vice President and then-presidential candidate Kamala Harris brought to light during her 2020 campaign. Citing... Personal Finance

Money at 30: "Part-Time for a Reason"

by Kyle Burbank

A couple of weeks ago, I had a chance to catch up with an old friend of mine I knew from my days in Los Angeles. Among the many topics we covered as we sat at an outdoor shopping center for the better part of three hours was her work. Detailing some of the struggles and frustrations she has with her employer in recent months, she said something that caught...

Credit Score Guide

Building Credit: What Consumers Need to Know and Tools to Try

by Kyle Burbank

In the United States, consumers rely on their credit scores in a number of ways. Not only can your scores come into play when applying for a loan, mortgage, or credit card but can also be a factor when setting up utilities, starting wireless phone service, and much more. Heck, your prospective employer may even do a credit check on you. Yet, given the importance of credit in our society,...

Product Reviews

Money at 30: Karat Creator Card Review

by Kyle Burbank

I don't remember the first time I heard about Karat — but I know I've seen it plenty of times since. Each time I'd come across it on Instagram, I'd visit their site, only to learn that it was still invite-only. Luckily for me, a few months ago, I actually came across an invite code and was finally able to apply... only for the platform to seemingly open up to the...

Pets

Money at 30: Lessons Learned from My International Dog Sitting Adventure

by Kyle Burbank

A few months back, I wrote a post sharing that my wife and I were considering adopting a dog while also recounting some of costs we were totaling up as we furthered our research. Well, thanks to some unexpected travels, our plans to get a pup of our own have been delayed. But, in the meantime, we're getting a small trial run this week as we pet sit for a...

Personal Finance

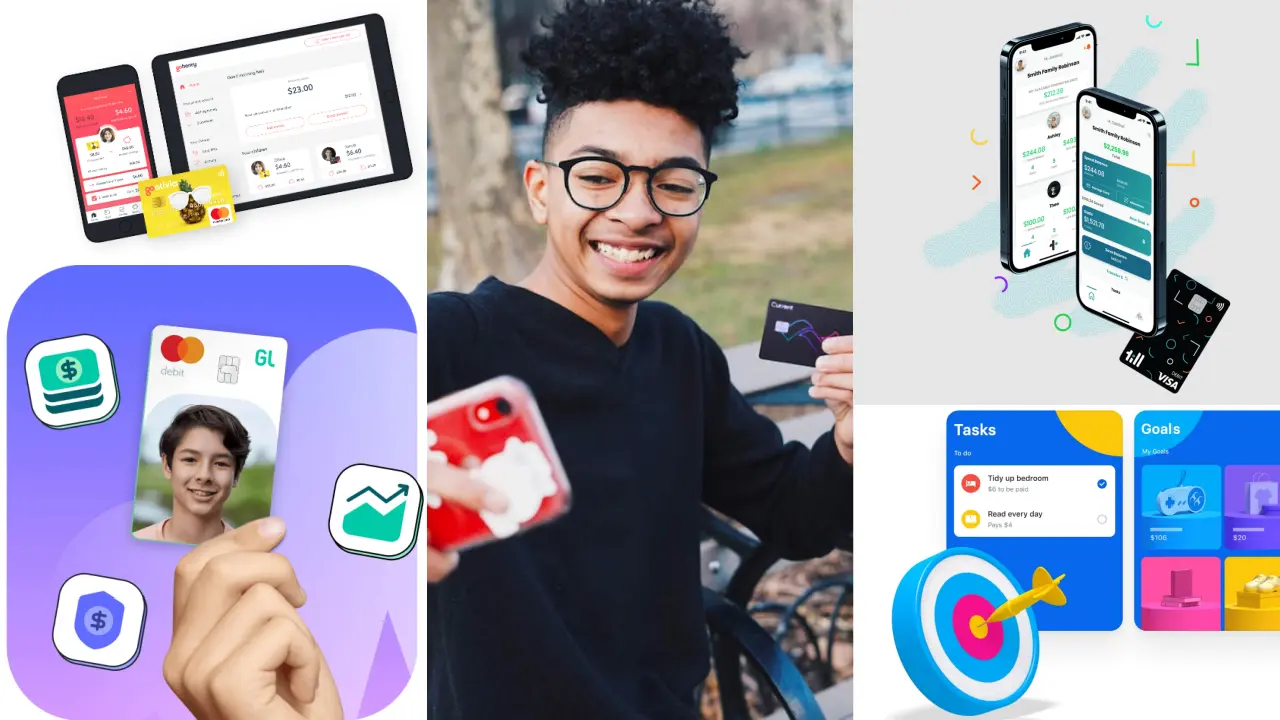

A Round-Up of FinTech Banking Options for Teens and Kids

by Kyle Burbank

One of the important lessons we learn in our lives is how to manage our money. Yet, financial education is often lacking from the curriculum taught to students in school. Furthermore, while learning the basics from books and lessons can be helpful, it's the "real world" experience that can really drive these principles home. That's why, in recent years, a number of financial technology companies (or "FinTechs") have created platforms...

Money Management Product Reviews

Money at 30: FloatMe App Review

by Kyle Burbank

Over the years, there have definitely been times when I really could have used a few extra dollars in my bank account before payday arrived. Lacking options, my younger days were filled with overdraft fees that only made my financial situation worse. Luckily, these days, there are a growing number of tools that consumers can use to not only avoid these dreaded overdraft fees but also hopefully avoid pricey payday...