Checking Account Review

Aspiration Plus Review: Is the Account Option Worth It?

Over the past couple of years, even as I’ve opened plenty of other online banking accounts to review, there’s been one that’s stood out to me as doing something truly different: Aspiration. With their “Do Well. Do Good.” motto and balance between banking perks and environmental protection, they definitely made a mark — even getting the attention of Oscar winner Leo DiCaprio. Meanwhile, keeping up with Aspiration has proven to be a full-time job as the offering has routinely made sweeping changes to their accounts.

The latest change to Aspiration actually comes with its own name: Aspiration Plus. This new option includes some added benefits for those who upgrade — including some that speak to Aspiration’s environmental message. Yet the real question remains, “is it a good deal for consumers?”

Let’s take a look at what you need to know about Aspiration Plus.

What is Aspiration Plus?

In April 2020, the online banking service Aspiration announced a new tier of service dubbed Aspiration Plus. For an added fee, users can unlock some added bonuses and features. What are these perks, you ask? Let’s take a look at the main offerings:

Updated debit card

First, those who sign-up for Aspiration Plus will receive a new debit card. In addition to featuring an attractive new and more modern design, the card itself represents Aspiration’s larger mission, as each is created from recycled ocean plastic. To be fair, the new American Express Green Card (and perhaps others I’m unaware of) beat them to this gimmick, but the card looks great regardless.

Earning interest

Next up, Aspiration Plus allows customers to earn as much as 1% APY on their savings. While that’s good news for those who upgrade, sadly it also means that those who don’t will be left out in the cold as regular Aspiration accounts will no longer accrue interest. Moreover, in order to reach that 1% APY, Plus account holders will still need to meet some requirements. Here’s a quick breakdown:

- Aspiration Plus customers will earn 0.25% APY on the first $10,000 in their Save Accounts

- Aspiration Plus customers who also spend $1,000 a month on their debit card will earn 1% APY on the first $10,000 in their Save Accounts

- Funds over $10,000 will earn 0.10% APY

It’s worth noting that the spend requirement is new to Aspiration as previous APY-boosting offers revolved more around the amount of money that was going into your account, not out. By the way, we’ll get to my thoughts on this arrangement and the other features of Aspiration Plus in the “Is Aspiration Plus a Good Deal?” section. But for now, *bites tongue*

ATM reimbursement

Just a day before Aspiration Plus was first announced, Aspiration also revealed that they had joined the Allpoint ATM network. This meant that customers would immediately have access to more than 55,000 free ATMs nationwide. However, it also meant that the company would be discontinuing their ATM reimbursement program, which most recently entitled customers to up to five reimbursements of ATM fees incurred anywhere in the world.

Well, in addition to having access to the Allpoint network ATMs, Aspiration Plus customers will also receive one out-of-network ATM fee reimbursed per month. Notably, in the case of international ATMs, Aspiration will continue to credit these transactions at a standard rate of $4. Moreover, should fees exceed this $4 threshold, the company says that users will still be able to submit their receipts in order to obtain full reimbursement.

Cashback bump

Currently, Aspiration customers can earn cash back on select debit card purchases via a couple of different programs. For one, the service maintains a list of businesses with high Aspiration Impact Measurement (AIM) scores and allows cardholders to earn 0.5% back on purchases from these companies. Some of these include some major brands such as Apple, AT&T, Target, Walmart, and more (you can view a full list here). On top of that, Aspiration also boasts special offers for businesses in the Conscience Coalition, with cashback offers ranging from 3% to 5%. This list includes the likes of Blue Apron, TOMS, Warby Parker, and others (that list is here).

Luckily for Aspiration Plus members, the cashback rate for Conscience Coalition purchases is upped to a whopping 10% with no limit to the cashback you can earn. In particular, this could be a big deal for Blue Apron customers as that is a recurring expense. Of course, those in search of new shoes or glasses can easily benefit too.

Planet Protection

Last but not least, Aspiration has also included their Planet Protection program in the new Aspiration Plus option. If you’re not familiar, with Planet Protection, Aspiration will automatically purchase carbon offsets in a bid to make your driving and gasoline consumption carbon neutral. At this time, Planet Protection is no longer offered as an a la carte option and is now exclusively a part of the Aspiration Plus package.

Is Aspiration Plus a Good Deal?

Now that you have a bit better idea of what Aspiration Plus offers, there’s another big question to address: “is it worth it?” To answer that, let’s take a look at the cost of Aspiration Plus, as well as some of my thoughts on the program.

The cost

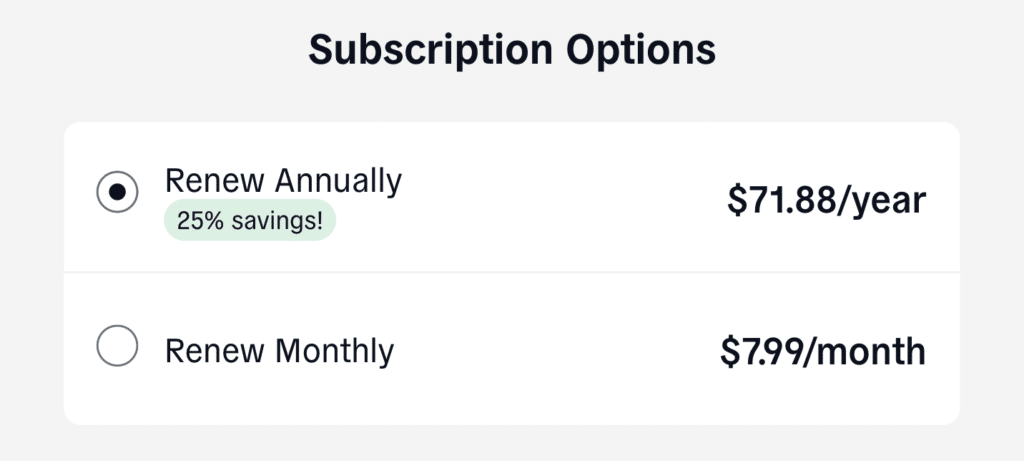

In order to answer the question, “Is Aspiration Plus worth it?” we must first look at how much it costs. Currently customers can join Aspiration Plus for $7.99 a month or $71.88 for a year if paid upfront. However, this price has fluctuated a lot over the past year. While it debuted at a $3.99 per month price line, it later went to $7 a month and then (outrageously) to $14.99 a month before reaching its current level. To their credit, it does seem as though Aspiration locks in users at the price they sign-up at, but the constant pricing changes are an off-putting element of this account.

On the other hand, I do need to point out that Aspiration was previously asking $5.99 a month for Planet Protection on its own. From that aspect, perhaps the (current) $7.99 isn’t the worst deal.

Compared to the Aspiration of yore

It’s impossible for me to write about Aspiration Plus without mentioning how much the bank has changed in just the past year or so. At one time, not only did they offer unlimited ATM reimbursements for any machine in the world but also allowed users to earn interest so long as they deposited just $1 a month into their account. Since then, they’ve slowly chipped away at that, frequently installing different and heightened requirements while scaling back perks.

In my mind, the largest shift was when Aspiration went from requiring users to deposit at least $2,000 a month in order to earn APY to moving to a model where you needed to spend $1,000 a month instead. Honestly, I really feel bad for those who made good faith efforts to move their banking business over to Aspiration and set-up things like direct deposits only to be told that they’ll need to spend $1,000 a month in order to earn any interest — while also charging whatever they’re going to be charging that month. That, more than anything, is what bugs me about Aspiration Plus and makes it harder to appreciate the account’s admitted benefits.

My final thoughts on Aspiration Plus

I can’t say that there aren’t things to like about Aspiration Plus. For one, I will say that the new debit card design looks great — and the opportunity to earn up to 10% cash back with said debit card is pretty great. Also, for as much as I hate paying bank fees, $7.99 a month isn’t insanely steep. Then again, if the price does shoot back up to $14.99, it’d be a different story as that’s a pretty striking pricepoint even when compared to dreaded big banks.

On the other hand, I have to say that I think the $1,000 a month spending required to boost your APY to 1% is ridiculous and really sullies the entire offering. Also, once again, I can’t help but point out that the ATM perk is kind of a joke since it’s literally one-fifth of what they used to offer to all customers mere weeks before this upgrade launched. Still, for those who aren’t hung up on the past, like the idea of Planet Protection, and frequent other Conscience Coalition brands, the Aspiration Plus offering may well be worth it.

Of course I have to add that, as Aspiration has shown, the current features and benefits of Aspiration Plus could well change next week. Heck, I saw the price of this product more than double in between two marketing emails they sent me between November 22nd, 2020 and November 27th, 2020 (before it was later lowered to $7.99 in April 2021. These constant changes and charges make me wonder about the future of Aspiration. Therefore, it makes it even harder to recommend them and really does a disservice to their mission in my view.