Small Business News

Are Small Businesses Financially Ready to Reopen?

Following weeks of mandatory shelter-in-place orders that forced the closure of many “non-essential” businesses across the country, phased reopenings have begun in several states and cities. That may sound like great news for small business owners who have been unable to operate for months. However, the financial realities of reopening may complicate the decision whether or not to resume businesses.

According to a recent survey conducted by LendingTree, 60% of small business owners intend on reopening their doors as soon as they’re allowed to, while 15% expect it will take a bit longer for them to prepare and 26% aren’t sure what the best way to proceed will be. That hesitation may be because 46% of those surveyed anticipate that they’ll see less revenue when they reopen than they had before closing. In fact only 17% expect the same number of customers to return to their store right away.

As for what efforts business owners are making to bring consumers back, 54% said they plan on alerting customers via email. The next most popular tactic is to offer special promotions or sales, which 43% of respondents say they planned to try. Meanwhile 35% say they’ll be using organic social media posts to reach customers and 31% will add paid social media ads to the mix. Surprisingly, 9% of those surveyed said they didn’t currently have any plans to promote their business after reopening.

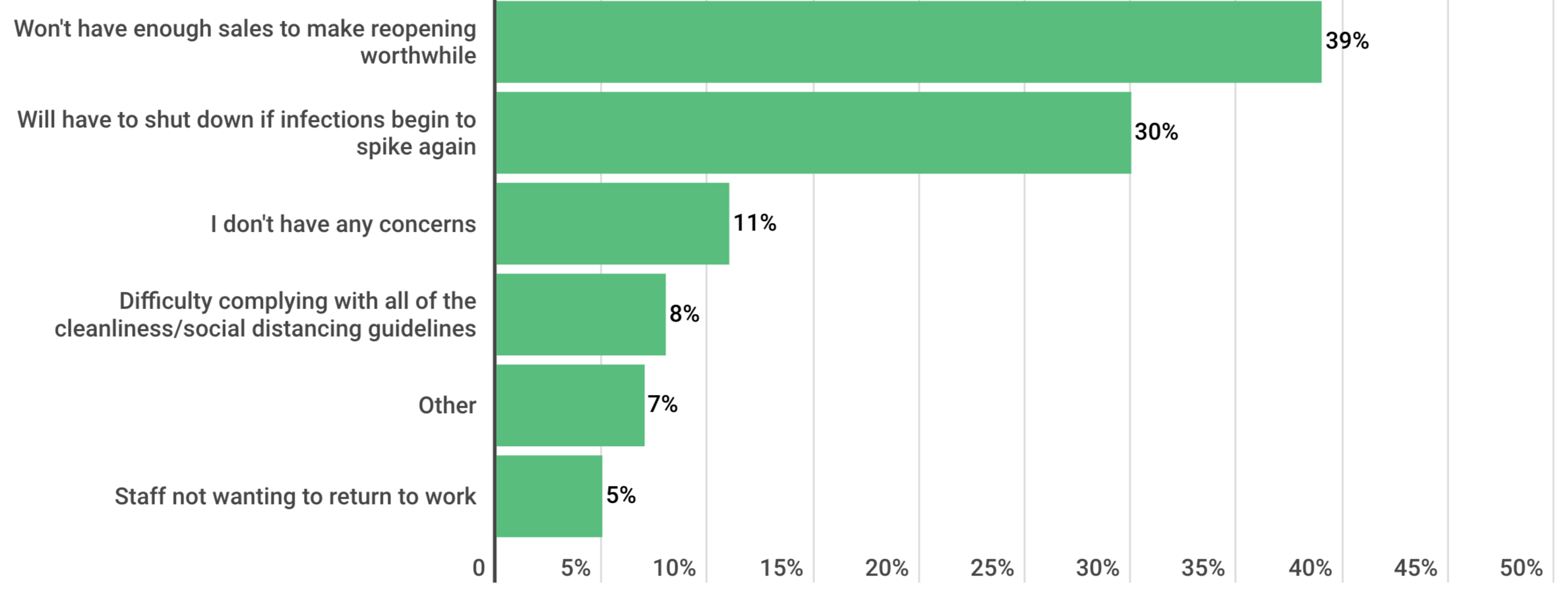

Asked what their biggest concern about reopening was, 39% of respondents cited worries that they won’t have enough sales to make reopening cost-effective. Stepping outside of finances, 30% said they feared having to close once again if infection rates increased. Additionally 8% said they worried about their ability to meet all health guidelines while operating and 5% had concerns about staff not wanting to return to work. However, 11% of those surveyed stated that they didn’t currently have any qualms about reopening.

While a significant number of businesses that spoke with LendingTree (40%) had received Paycheck Protection Program funds, it seems their troubles aren’t exactly rectified. Instead 24% of recipients surveyed say they’re “very concerned” about meeting the qualifications for loan forgiveness. Another 29% were at least “a little” concerned about the same prospect.

It’s clear that, while parts of the nation are slowing reopening, things are certainly not back to normal. Because of this, small business owners continue to face a number of financial decisions to make as they navigate the road ahead. Although there may be hesitation and headwinds for now, with time, America’s entrepreneurs and small businesses will bounce back.