FinTech News

Apple Officially Announces “Apple Pay Later” BNPL Service

Apple may not be a traditional FinTech, but once again it’s about to expand its financial technology bonafides. After previously launching its own mobile wallet, credit card, and more, the company is now set to enter the “Buy Now, Pay Later” (BNPL) market. At this year’s Worldwide Developer’s Conference, Apple unveiled its upcoming feature Apple Pay Later.

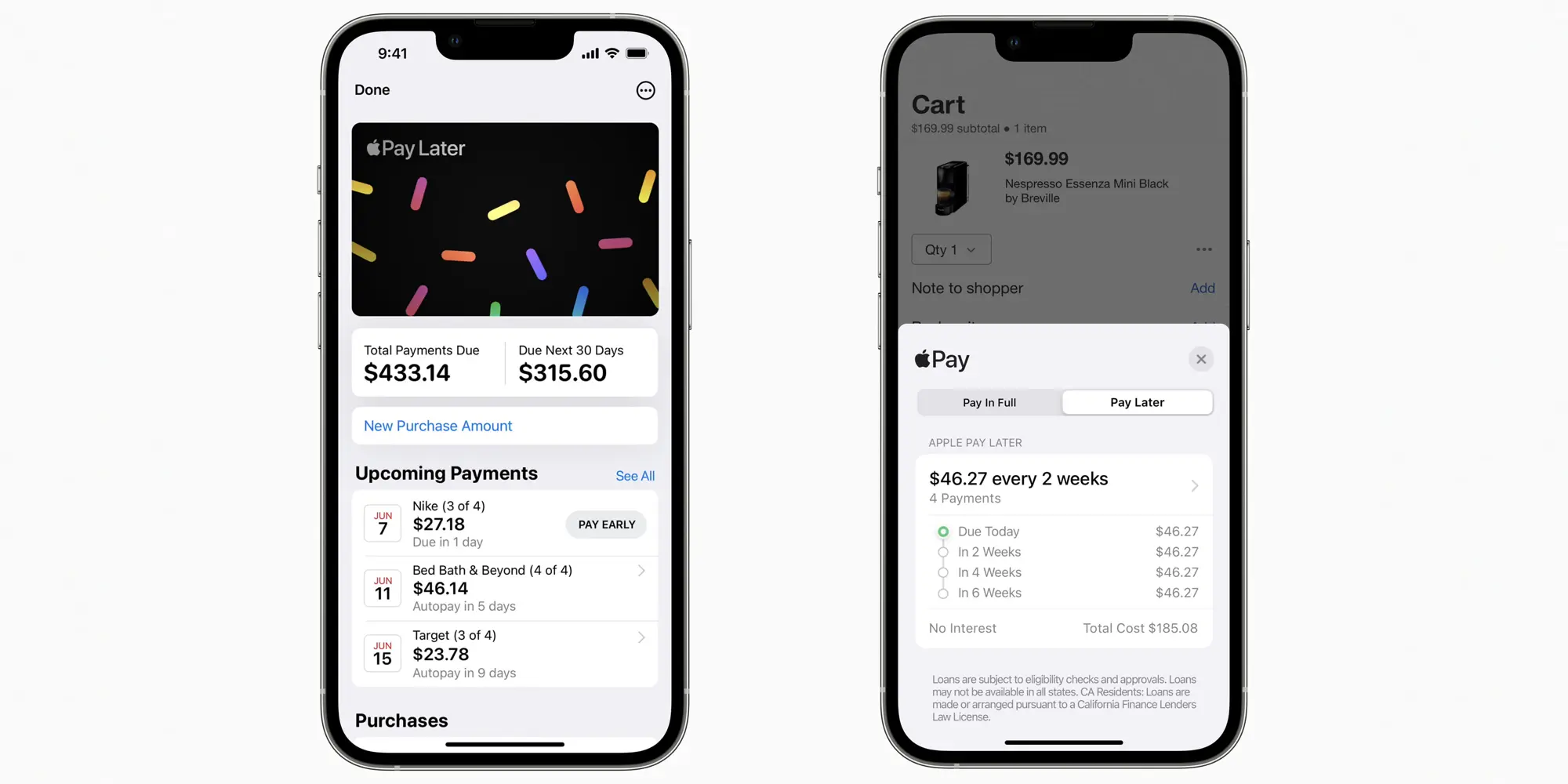

Like many other BNPL options, Apple Pay Later will allow customers to make purchases and pay for them via four installment payments over six weeks (one quarter due upfront followed by additional payments every 2 weeks). The service will come with no fees or interest. It will also be available anywhere Apple Pay is accepted — including online and in-app — and will operate on the Mastercard network. While not explicitly mentioned in Apple’s press release, a screenshot image shared by the company does note that loans may not be available in all states.

Seeing as the announcement was made at WWDC, it’s worth noting that there is nothing for developers to integrate with this feature. Instead, it will be part of Apple’s upcoming iOS 16.

When customers use Apple Pay Later, they’ll then be able to see an overview of their purchases and upcoming payments in the Wallet app. Additionally, users can choose to make early payments toward their purchases. The announcement of Apple Pay Later was also made in conjunction with Apple Pay Order Tracking, which will enable customers to view order shipping info right from Wallet.

Looking at the current state of things, it’s easy to see why Apple would want to give “Buy Now, Pay Later” a try. For one, it already has nearly all of the pieces in place. More importantly, demand for BNPL has continued to surge. That said, the increasingly crowded marketplace has started to take a toll on some companies. For example, Klarna — which recently launched its unique Klarna Card — was forced to lay off 10% of its workforce last month.

Overall, it will be fascinating to see how Apple’s participation in the BNPL bonanza impacts the sector. Although it might be easy to assume that the company’s success with the feature will come at the expense of other platforms, there’s also the chance that Apple’s legitimization of the concept actually boosts others — especially among those outside of the Apple ecosystem. With iOS 16 expected to launch publicly this fall, we’ll hopefully be getting more details on Apple Pay Later in the coming weeks.