FinTech News

Apple Card Adds Ability to Export Transactions Spreadsheet

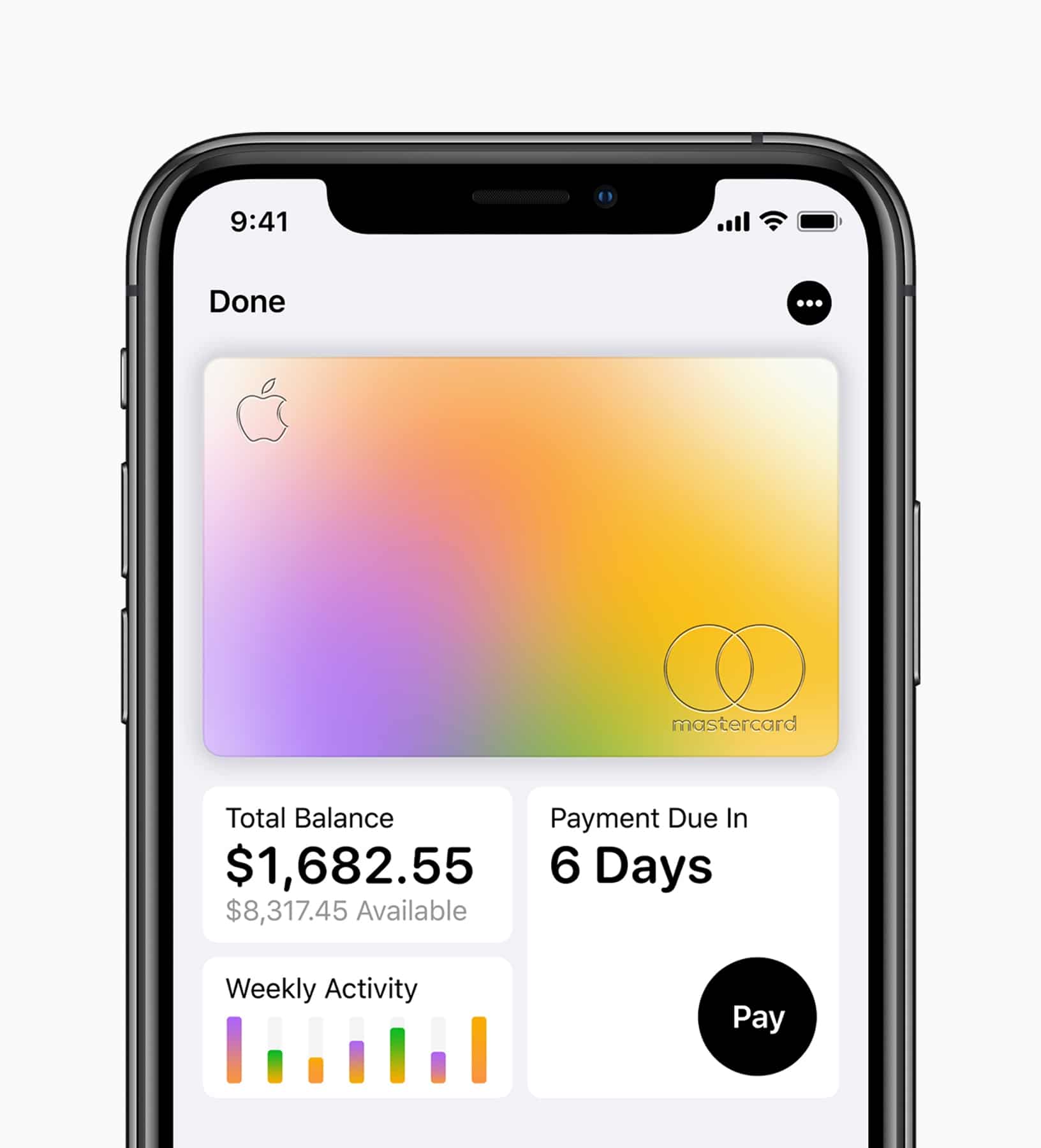

When the Apple Card launched in August of last year, it was perhaps the most high-profile example of FinTech seen to date. At the same time the card itself wasn’t exactly built to play nice with other FinTech products as it offered no way for users to link their accounts to personal finance and budgeting applications. Thankfully, as TechCrunch reports, Apple is now working to correct that, offering a solution that may appease at least a few cardholders.

With a new update, cardholders can now export their Apple Card statements as .csv (comma-separated values file) sheets. To do this, users can visit their Wallet, select their Apple Card, tap the “Card Balance” section in the upper left corner, choose a monthly statement, and then tap “export transactions.” Spreadsheets can then be sent via Airdrop, Messages, email, Dropbox, and other means. Note that, because this feature is still being rolled out, it may not be available to all users for a few days.

Although the ability to export these transactions can be useful for cardholders who rely on programs such as Quickbooks to keep track of their finances, some popular budget apps like Mint don’t support importing such files. Therefore, while this new functionally may be welcome, it may not make up for the inability to link the Apple Card via services such as Plaid.

The rollout is the latest update to the card that gives it some of the functionality that more traditional credit cards offer. For example, it was only a few weeks ago that open Apple Card account began showing on users’ credit reports. That said, in that case the blame likely laid on partner bank Goldman Sachs (this is the firm’s first credit card as well) whereas the previous lack of an export option would seemingly fall at Apple’s feet. Meanwhile there are still improvements critics of the card would like to see such as a sign-up bonus — something Apple Card lacks entirely. However, to be fair, Apple has added value to their card since its debut by adding partner brands to their 3% Daily Cash category. Currently users can earn 3% back when they use their cards with Uber, Walgreens/Duane Reade, Nike, and in-store at T-Mobile. Of course, Apple purchases also qualify for 3% back and the company introduced interest-free iPhone financing through the card late last year.

While it may be an imperfect solution to the problem at hand, there’s no doubt that Apple adding export abilities to their card is a positive step forward for users. Still one can’t help but hope that this is just a temporary fix while the company finds a better way to serve its customers clamoring for greater functionality. So although Apple is famous for being a company that shows consumers what they want before they know it themselves, perhaps in this case the gang in Cupertino will take a cue from its users instead.