Small Business News

American Express Global Pay for Small Businesses Launches

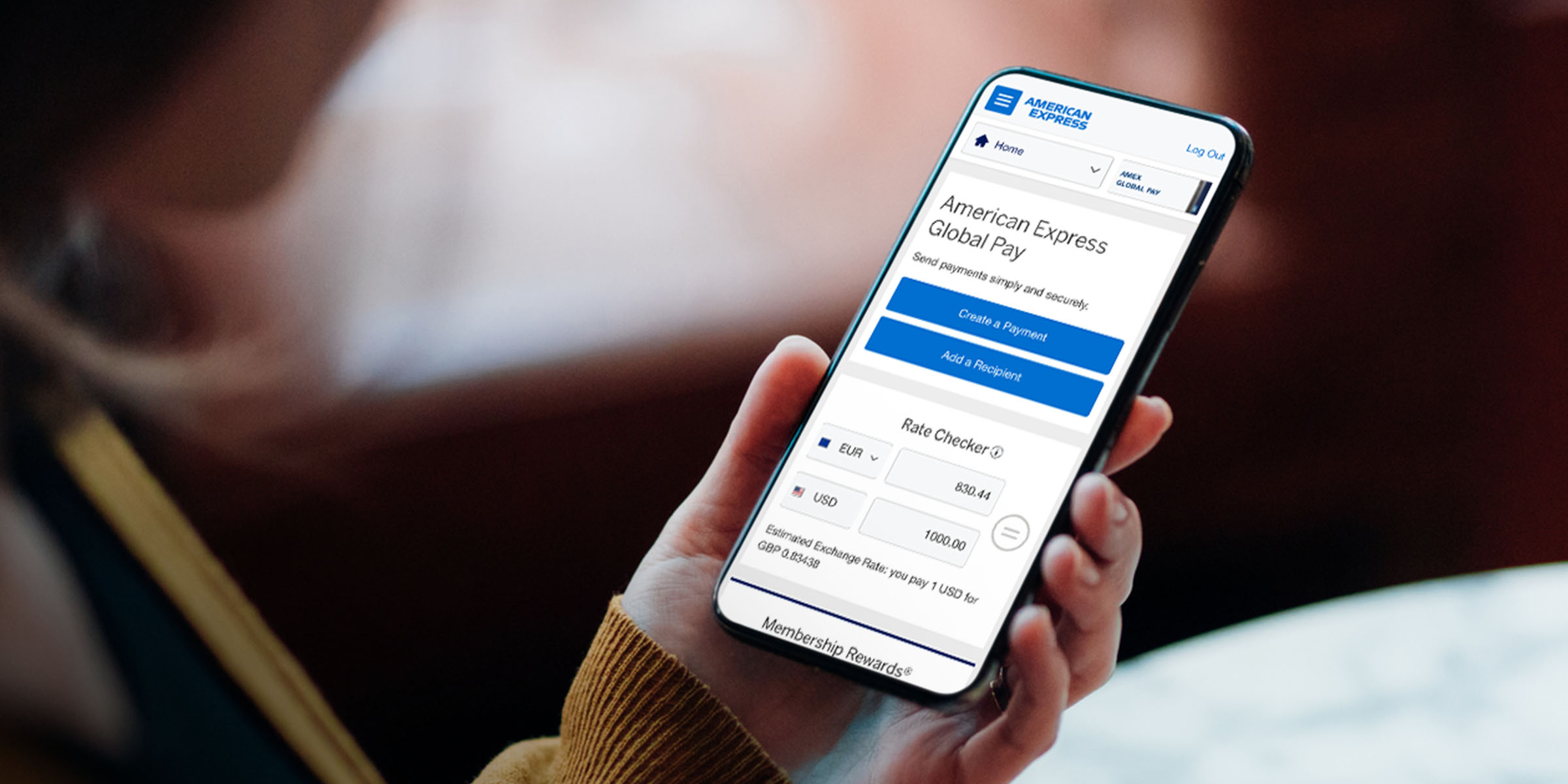

A new offering from American Express is aiming to make international business-to-business payments easier for owners. This week, the company announced the launch of Global Pay. Using this digital platform, U.S. small businesses can make secure B2B payments to suppliers in more than 40 countries. With the mobile-friendly service, businesses will be able to see exchange rates at the time that they create payments and will be able to view an estimated payment delivery date. For select countries and currencies, same-day business payments may also be available.

Global Pay is now being offered to Amex Small Business Card members. What’s more, eligible cardholders can earn Membership Rewards points on the Global Pay transactions they make. To celebrate the launch, currently (through the end of the year) small businesses will enjoy a 90-Day waiver of American Express fees on foreign exchange payments after they are approved for American Express Global Pay. Card members can apply for Global Pay on the Amex site.

The arrival of Global Pay comes as a recent American Express survey found that U.S. small businesses are discovering a greater need for international payment solutions. According to the survey, 64% of business owners stated that they expect to spend more with businesses outside of the United States over the next six months.

Furthermore, 43% said that the reason behind this increase was due to a wider range of products and services available, while 35% said that supply chain diversification was their reason for exploring international B2B transactions. However, 27% of respondents reported that making cross-border payments was complex, with 48% saying they were looking for a payment service with transparent fees.

Commenting on the debut of Global Pay, American Express’s EVP of Global Commercial Services Dean Henry said, “Businesses today start, grow, and compete on a global scale.” Henry continued, “Our U.S. Small Business Card Members told us they want an international payment solution focused on simplicity, convenience, and the chance to earn rewards – so we built American Express Global Pay to enable these businesses to easily and effectively manage their B2B payments globally on a secure platform, backed by the trusted service and unique benefits of American Express Membership.”

While cross-border payments may not be something that all small businesses have to deal with, those who do may find value in American Express’s latest offering. Specifically, the platform could definitely be beneficial for small business owners that are part of the Amex ecosystem — especially since they could earn Membership Rewards points. With Amex offering a 90-Day waiver of its fees for a limited time, it may be worth giving the service a shot before the year’s end.