Personal Finance News

Amazon to Add Venmo Payment Option Ahead of Black Friday

Those shopping online this holiday season could see a new payment option pop up on an uber-popular retail site. Today, Amazon announced that it would soon offer Venmo as a payment option on its site and within its mobile app. While this feature will begin to be available to select users starting today, the company expects it to be open to all customers in the United States by Black Friday.

While this new functionality is rolling out now, it was first teased nearly one year ago. At the time, Venmo cited a study suggesting that 47% of Venmo customers said they’d be interested in using the service to pay for purchases from retailers.

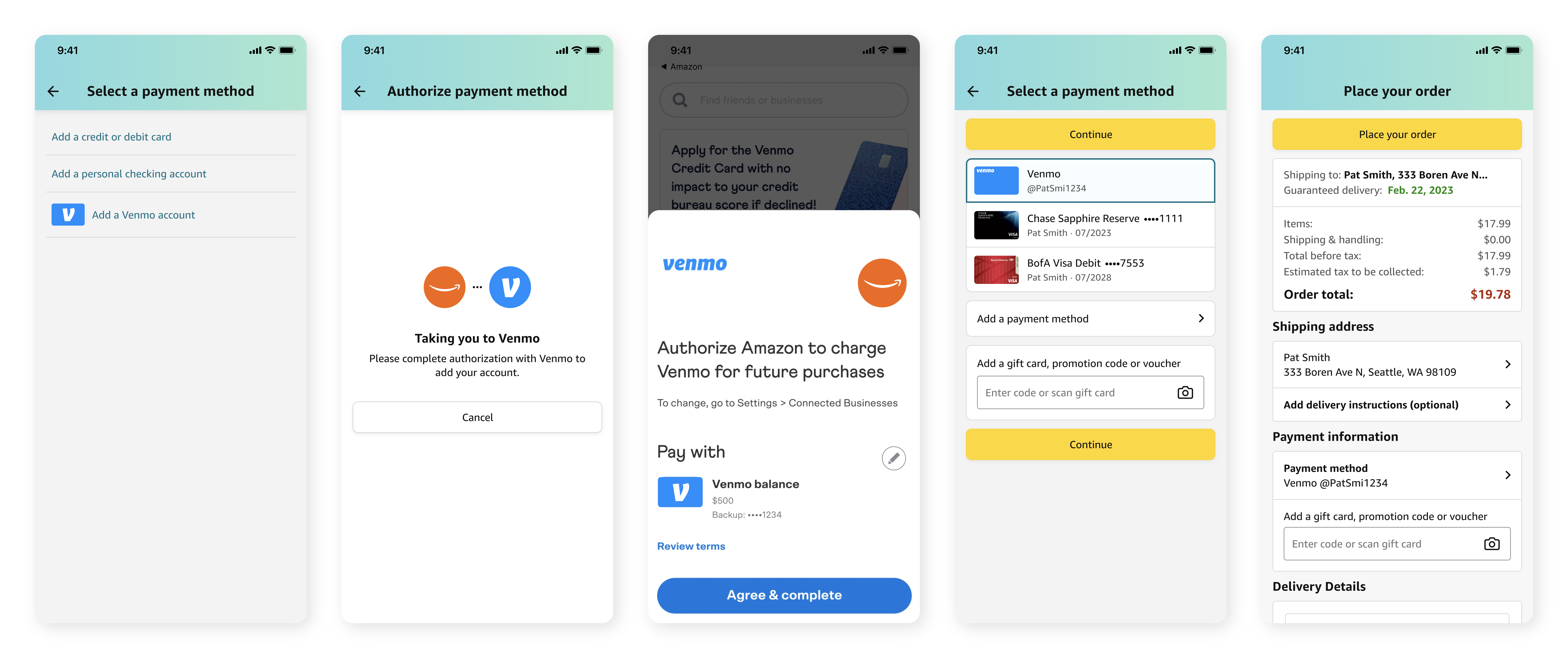

According to Amazon, to get started with using Venmo on the platform, customers will link their Venmo account. From there, users will be able to choose the Venmo option at checkout. Similarly, shoppers can elect to set it as their default payment option.

Venmo now joins a growing number of ways that customers can pay for orders on Amazon. In addition to accepting credit, debit, and gift cards, Amazon also partners with a number of credit card reward and loyalty programs. For example, users can currently redeem Hilton Honors, American Express Membership Rewards, Chase Ultimate Rewards, and many other point currencies to complete payments (although these programs may have different values for points redeemed on Amazon).

Elsewhere, the online retailer has also launched unique features, such as Amazon Cash to give those without credit or debit cards another option for shopping online. Notably, one payment option that’s not currently available is PayPal — which is Venmo’s parent company.

Announcing the addition of Venmo as a payment option, Amazon Worldwide Payments VP Max Bardon said in a statement, “We want to offer customers payment options that are convenient, easy to use, and secure—and there’s no better time for that than the busy holiday season. Whether it’s paying with cash, buying now and paying later, or now paying via Venmo, our goal is to meet the needs and preferences of every Amazon customer.” Bardon added, “We’re excited to continue to offer customers even more options when it comes to how and when they want to pay for their order.”

Meanwhile, PayPal’s SVP, GM, and head of consumer Doug Bland said of the partnership, “We know that the Venmo community of nearly 90 million users value the safety, security, ease, and familiarity that paying with Venmo helps to bring to the checkout experience. The ability to pay with Venmo on Amazon continues our ongoing commitment to offer the community more ways to spend, send, receive, and manage their money with Venmo.”

Given the popularity of the Venmo platform, it makes a lot of sense that die-hard users would want the ability to use their accounts elsewhere. Sure enough, Amazon seems like a great place to expand that capability. So, as the holiday shopping season approaches, Venmo customers and Amazon shoppers should be on the lookout for this new option.