Personal Finance News

2022 Holiday Debt Reaches Record High in LendingTree Survey

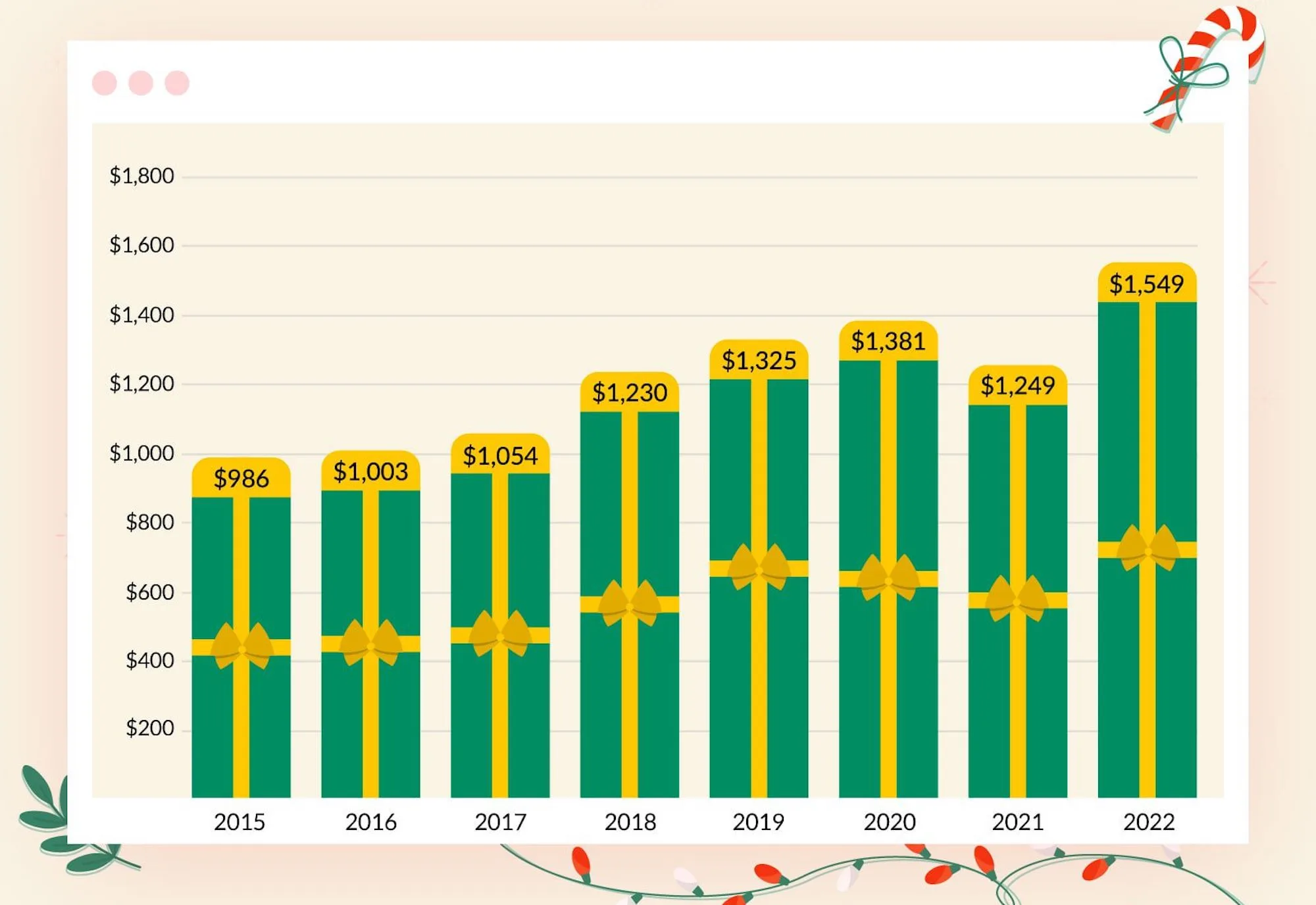

With the holiday shopping season now in the rearview and the New Year just ahead, an annual survey from LendingTree is assessing the damage done to consumers’ debt load over the course of the season. First, although the survey found that slightly fewer Americans took on holiday debt this year compared to last (35% of respondents versus 36% in 2021), the average debt taken on rose. In fact, the $1,549 total marked the highest number seen in this survey’s eight-year history. What’s more, this year marked a $300 increase from 2021’s $1,249 average. In contrast, in 2015, the average was only $986.

Unfortunately, a majority of consumers who took on holiday debt didn’t plan to do so. According to this year’s survey, 63% found themselves in that situation, which was up from 54% last year.

As for how long those who took on holiday debt expect to hold onto it, 37% of respondents report that they expect to pay it off in five months or more. Notably, that’s up from 28% who said the same in last year’s survey. Gen Xers were also more likely to expect this longer timeline (47%) as were women (42%).

The rise in holiday debt can partially be contributed to the rising inflation rates that have plagued the United States economy all year. Although inflation has cooled in recent months, the latest report (November) shows the Consumer Price Index rising more than 7% year over year. In more bad news for consumers with debt, the Federal Reserve has been aggressively raising interest rates, which means that those carrying a balance on their credit cards could be paying even more.

Commenting on the latest survey’s results, LendingTree chief credit analyst Matt Schulz stated, “For millions of Americans, it’s not possible to pay off their credit cards in full regularly. Life is expensive in 2022, and it isn’t going to get any less so in 2023.” Schulz continued, “That means that people’s financial wiggle room is almost zero, so any unexpected expense can put them in debt whether they like it or not.”

While it may not be shocking to discover that a number of Americans incurred debt during the holiday season, the rise in interest rates and the uncertain economic outlook could spell disaster. Therefore, although it certainly won’t be easy, the 37% of respondents who don’t expect to pay off their debt for at least five months should strive to shorten that timeline however possible. Otherwise, these 2022 mistakes could have financial ramifications well into 2023.