FinTech News

Greenlight Introduces Level Up Financial Education Game

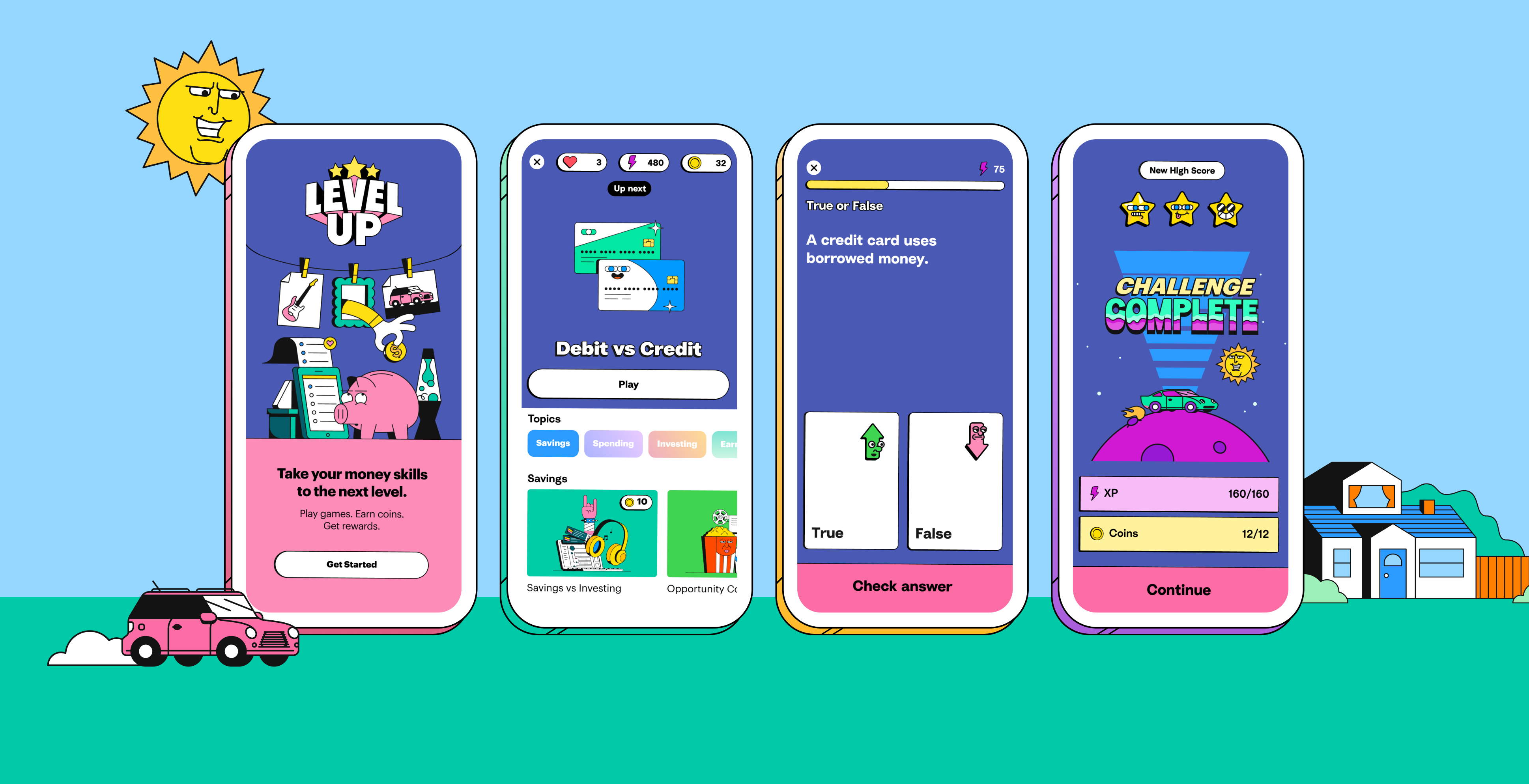

A FinTech focused on family finance is rolling out a new feature that will help children and teens learn about money in fun ways. Recently, Greenlight announced it’s newest feature: Level Up.

Greenlight describes Level Up as an interactive, curriculum-based financial literacy game. According to the company, the game’s curriculum goes beyond the National Standards for K-12 Personal Financial Education, which were developed by the Jump$tart Coalition and Council for Economic Education. Some of the topics covered include earning, spending, saving, investing, credit, taxes, and more. Lessons in the game feature videos, minigames, and a variety of question types, such as multiple-choice, true or false, and scenario questions.

Level Up is a multi-sensory experience, combining the written word, illustrations, and sounds. As players complete challenges, they’ll be rewarded with Greenlight Coins, XP, and stars. They’ll also be able to earn badges in the app.

The Level Up feature is the latest addition to the Greenlight platform, which allows parents to teach their kids about money by giving them their own debit card. Children and teens can set savings goals, receive allowances, view insights about their money, and more. Additional features and perks, such as increased Savings Rewards, are also included with higher-tier Greenlight plans. Currently, the company offers three plans, with monthly pricing ranging from $4.99 to $14.98.

Meanwhile, the service also has a number of features for parents. Most recently, the company introduced the Family Cash credit card for adults, which allows them to earn up to 3% cashback on all purchases. To earn that level of cashback, cardholders will need to spend at least $4,000 a month on their card. Those who spend at least $1,000 a month on the card earn 2% back on purchases and all others earn 1% back.

Announcing the launch of Level Up, Greenlight’s Director of Education Jennifer Seitz said, “Greenlight’s mission has always been focused on empowering kids and teens to learn about money. Level Up advances our mission even further with an engaging, gamified curriculum that teaches financial literacy in a fun and relatable way.”

Offering a review of the feature, parent and beta user Nikki M. said of the game, “Level Up is such an amazing game.. Starting at the very first level, it has important lessons that I wish I was taught when I was younger. This is such valuable knowledge that my daughter will have for life.”

While other FinTechs such as Zogo and Long Game have sought to merge financial education with the fun of gaming, this latest feature feels like a natural addition for Greenlight. What’s more, given the nature of the app, children and teens may be able to act upon the lessons they learn and apply them to real life. With Greenlight already proving to be a FinTech on the rise, the addition of Level Up and other features could see the startup, well, leveling up themselves.